An Unfortunate Incident

"Ma'am, unfortunately, your credit score is too low for you to get a mortgage!" alerted the cashier. "What, how could it be? There must've been a mistake!" replied Cassidy, flabbergasted. It felt as if all her dreams came to a shattering stop.

Cassidy Gard, a popular TikToker, suffered a huge blow when she learned that getting a Home Depot credit card caused her credit card score to plummet so low that she no longer qualifies for a house mortgage! What happened next will make you go crazy with rage!

Cassidy Gard – Who is she?

The woman in consideration here is Cassidy Gard. She hails from Los Angeles and earns her bread by producing Television shows. She is quite popular on social media platforms like Instagram and TikTok. On Instagram, she has more than 70k followers. And there is more! Her bio mentions that Cassidy won Emmy awards twice!

Just like every successful woman out there, she too wanted to buy her own house but her dream of owning one suffered a huge blow for one stupid mistake!

Goes viral on TikTok

If there is one thing that we have come to understand about this modern-day and age, it is that it doesn’t take much for something to go viral. So when Cassidy shared the whole incident on her TikTok, it quickly gained 4 million views and tens of thousands of comments!

In the viral video uploaded on the TikTok platform, Cassidy can be seen making a public service announcement of sorts where she is explaining the whole incident. But what exactly happened?

Home depot

You probably have heard of Home Depot. It is the largest home improvement retailer in the United States. Over the past few years, The Home Depot has transformed itself into the go-to place for someone looking to upgrade, renovate or purchase a new home.

One day, when Cassidy was checking out at Home Depot, an employee convinced her to open a store credit card. After a bit of convincing, Cassidy agreed to get a store credit card. Little did she know that taking this impulsive decision would soon turn her life around!

Forgets about it

The whole thing happened so fast that Cassidy couldn’t even process what she was getting into. As she explained later on, after opening the card, she immediately forgot about it. And when she got it off her head, it caused the charge she put on the card to pay for a can of paint to go into default.

This small mistake of her forgetting about it was about to cost her a fortune as she later learnt that her credit score dropped over 100 points!

Credit and credit score

It is okay if you don’t know what credit or credit score is. We are here to sort you through! So basically, credit is sort of an agreement that allows you to borrow money and make certain purchases. But here’s the thing, you have to pay back the entire amount in a certain time frame.

On the other hand, a credit score keeps track of how well you are able to pay back the borrowed money. It helps lenders assess your level of risk as a borrower. A strong credit card score is crucial for buying a new home or opening a new credit card for that matter!

Rewards card

This is a delusional world that we are living in and a major chunk of this delusion has to be attributed to us, humans. We find a way to trick or delude people into agreeing to something they don’t want to. Something similar happened with Cassidy as the employee used a different language while she was persuading her to open the store credit card.

“Rather than saying credit card, the employee told me it was a rewards card,” Cassidy recalls the incident that drastically impacted her life.

Sign-up process

Cassidy wasn’t even totally aware that she was applying for a new line of credit. She thought that she was getting a discount for the can of paint. As she recalled the whole incident to BuzzFeed, she explained “I always say no to new credit cards.

That day too, I denied once but the lady was sort of persistent and followed up one more time. I guess the second time she asked me, I said ‘sure’ and then we began the sign-up process!”

A small can of paint

The sign-up process was quick and by the time she could realize what was happening, it had already happened. She further explained her mistake that if she had made a bigger purchase like a washing machine or a fridge, the charge wouldn’t have slipped her mind.

“It was much easier to forget about since it was just a can of paint for repairs I was doing in my kitchen,” Cassidy explained to BuzzFeed.

Credit card score plummeted

Since it was a credit amount, she had to return it but Cassidy forgot about it. In her own words “I never thought in my wildest dreams that such a small oversight could dip my credit score so significantly!” Cassidy’s $5.35 charge for the can of paint became delinquent over the course of the next four months.

For the uninitiated, credit card delinquency happens when a person falls behind on required monthly payments to credit card companies.

Disproportional mistake vs consequence

She was traveling during the summer and she never received an email notification about the due credit. At the same time, she made a non-refundable downpayment on a home.

“And now, even if I do qualify for this mortgage, my mortgage rate would be 3-5% higher than what it could have been before this terrible mistake happened” Cassidy recalled. Needless to say, the mistake vs the consequences she had to face because of it wasn’t proportional at all!

More people join the list

As we mentioned earlier, Cassidy’s case isn’t unique or rare at all. Cassidy, too, confirmed it when she received a rave response from the audience on her viral TikTok video. “I noticed a lot of people explaining their plight that charges between $5-$25 destroyed their credit score.

The common thread I kept seeing over and over was the different stores they committed their mistakes in.” Cassidy told BuzzFeed. Her case certainly resonated with a lot of people!

Automatic grace period

It is out in the open by now that despite their intention, people are getting deluded into opting for store credit cards. And moreover, people like Cassidy are suffering a lot because of such practices. While there isn’t any concrete solution to put an end to this, Cassidy believes that there should be an automatic grace period for these tiny amounts.

She believes that if it’s under $25, no one’s credit score should be destroyed like this! Because chances are, it could turn out to be the most expensive financial mistake you could ever commit!

People blaming her

As her TikTok video went viral, thousands of people flocked her comment section. Some believed that Home Depot wasn’t to blame in this situation and advised Gard to pay more attention to her finances. One user also commented this “Seems like you forgetting is the problem, not the store”.

To which, Cassidy Gard replied, “Yes, I am the problem. That is why this is a PSA. So if other people like me have a horrendous memory, they realize how damaging this can be.”

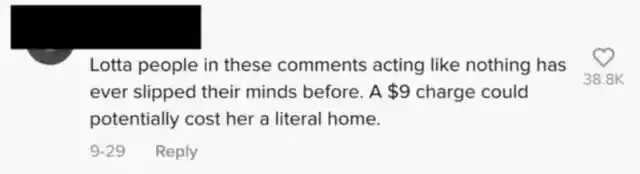

People supporting her

Not all people are the same and that stood true in her comment section as well. While some people blamed her, some people supported her as well. One user wrote “Lotta people in these comments acting like nothing has ever slipped their minds before.

A $9 charge could potentially cost her a literal home,”. Another user had this to say “So many of these comments are not passing the vibe check. First time home buyer here and doing everything right is HARD.”

Spoke to Citibank

If it weren’t for the house mortgage, Cassidy could have left this issue unsolved because it was a small amount of money but since her credit card score dipped significantly, Cassidy had to face some brutal consequences. She was willing and determined to sort it out and get her credit score repaired.

In the same wake, she spoke with CitiBank. If you don’t know this by now, CitiBank is the financial institution that runs the Home Depot store credit cards.

Citibank agrees

Cassidy was very persistent because obviously, it was a matter of her getting her own home and this whole fiasco was causing a big problem in her process of owning one. She explained it all to CitiBank and guess what? They agreed to make a one-time goodwill adjustment to repair her credit score.

She was overjoyed because her dream of owning her own house was finally inching closer to becoming a reality. But she had no idea what was about to happen next!

Disagreement

Cassidy started celebrating her victory that she would be finally able to secure a loan for her new home without paying any ‘extra’ bucks. Just when her life started getting back on track after this whole ruckus, she received a call from the bank.

This call was about to bring a drastic change in her life. She was informed that they would not be making any adjustments. Cassidy’s heart sank when she heard the words. What now?

An even bigger blow

When the bank manager called Cassidy to inform them that they wouldn’t be able to adjust her credit score, it was an even bigger blow for her than when she first found out her credit had plummeted from forgetting to pay the initial $5.35 charge.

We can very well understand her frustration because, at one point in time, she must have started assuming that everything was coming back on track.

Waiting game

Bank’s disagreement put her in a very bad state of mind. Her dream of owning her own home was fading in front of her eyes.

Talking about the current scenario, her credit score still hasn’t recovered from the initial blow and she is just playing the waiting game, patiently waiting for the bank lender to say something in this regard. But as far as past cases are considered, of the same genre, she is going to receive the same reply.

Misleading language

According to Cassidy, she thinks that her situation speaks to a much larger issue. First up, there’s the misleading language that the employees use to delude a potential customer.

They don’t present what they are offering as a new line of credit, instead, they are often peddled as a lower-risk ‘reward card’. This is exactly what happened in Cassidy’s case when she was presented with a ‘reward card’ which ended her dreams of owning her own abode.

The quota

However, just like everything present in this big wide universe, this too has a flip side. One of the comments on Cassidy’s TikTok post was from one of such employees. She revealed that they often need to use whatever means necessary to sell credit cards to reach the quotas set by their employer.

And also, if they don’t meet the quota, they get in some serious trouble. If we think in that way, this issue is very deep-rooted and isn’t limited to schematic employees.

Lack of common knowledge

Most of us who get sort of scammed this way don’t have any knowledge about it. In such situations, it's really hard to say who to blame?

Well, to some extent, we can put the blame on our education system that doesn’t teach us even the financial basics such as how to pay taxes, what is our credit score budgeting, money management, student loan debt, etc.

Financial illiteracy

Most of us have to resort to Google to find the necessary answers and to clear our basic finance fundamentals. Financial illiteracy is one of the major reasons why it is so easy to manipulate us into signing up for things that we don’t completely understand.

We see a lot of memes that poke fun of seniors talking Algebra and stuff but not knowing finance fundamentals.

Nature of companies

We can also blame the nature of the U.S. credit card system to some extent. While it does help people build credit, and if you are using a card that has a high points reward system, you can also get small amounts of money back.

Although it does help but only if you are careful about your payments and are regular with it. Otherwise, it won't help.

Fragile system

Cassidy learned the hard way how fragile our credit card system actually is! As she likes to mention “I always had a phenomenal credit score but it is kind of alarming how fragile our card system is!

That it dropped a whopping 100 points and that too, just because I couldn’t pay back a measly amount of $5.35!”

Helping others

The main reason why Cassidy made that viral video was because she wanted her experience to shine a light on a broader issue and evoke actual change for how credit card systems work.

She really wants people to learn from her mistake as she doesn’t want anyone else to go through whatever she has to.

Protocols should be there

The misleading language used by the employee actually got Cassidy into this never-ending trouble. She wants companies to adopt some protocols “There should be some guidelines regarding how credit cards are represented to shoppers in stores.

They shouldn’t mention credit cards as reward cars because both of them are completely different!” And we couldn’t agree more with Cassidy!

More information

It all happened in such a jiffy that by the time Cassidy could realize what was going on, she already had a store credit card registered under her name. This really pissed her off later when she got to know that her credit score had plummeted so much.

As she likes to put it – “The process should be much longer while applying for a credit card and also, employees should present more information to us than the amount of time it takes to buy a piece of gum!”

The lesson

While we cannot put an end to this, we, ourselves, can become more financially literate. It is absolutely necessary to be completely aware of what you are getting into because sometimes, the consequences could be huge as compared to the stupid little mistake you might commit.

Cassidy’s mistake has taught us that we should be completely conscious about what we are signing up for. Tell us what you thought of this story by commenting down below! Oh, feel free to check out our other amazing articles as well!