The Modern-age Revolution

Today we have a story of revolution. A very unique one. While you normally think of guillotines and guns when it comes to revolution, this is a special one made by 0 and 1’s. We have the privilege to be witnesses (and participators) of the power of the collective being tested and triumphing (for now) over the all-powerful 1%.

The Beginning

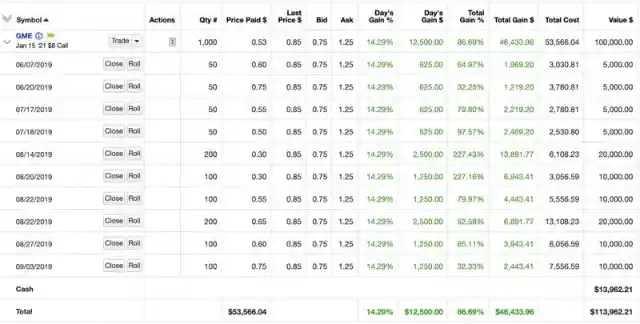

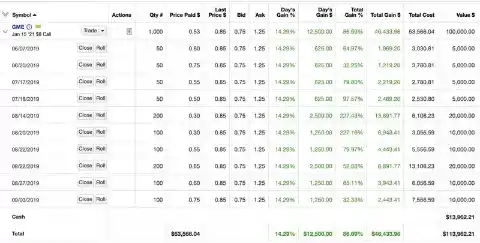

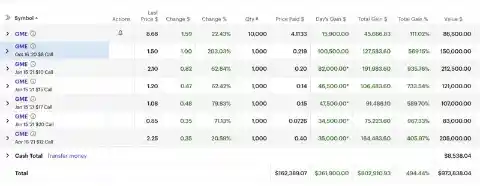

It all starts with Reddit (as it usually does). On the subreddit r/wallstreetbets, a subreddit was created for discussions about the stocks. As usual, it has the uniqueness of Reddit, with millions of users posting memes and pictures, upvoting and discussing, with a note of self-loathing. Well, in this subreddit many people are posting their positions in the market. This is what one of the users did. And just that was enough to start the whole story.

He Did It

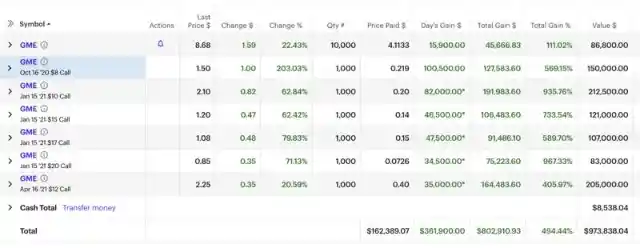

Reddit user u/DeepFuckingValue had posted a few times his position with Gamestop’s stock options as it was increasing through time. Also, there he had mentioned that the stock of the company was underpriced for what the company was worth. And what he had predicted happened.

So Much Money

Many people were seeing his monthly posted photos on Reddit, with his balance ever-growing. Then, as a self-fulfilled prophecy, people started buying shares and options of the stock, driving the price higher and higher. To get an idea of the increase of the stock’s price, just look at the value of one share on the 1st of January (18 $), and then on the 29th of January (325 $). This astronomical increase of almost 2,000% had huge consequences.

The Plan

As it usually happens, when the poor guys are having fun, the rich guys are trying to find ways how to profit from them. And the way the stock market is set up, the rich guys have the advantage. So, they decided to use this advantage to make a lot of people poor, and themselves much richer. They did that by taking advantage of what we call “shorting a stock”.

Shorting Stocks

To keep it simple, when you are shorting a stock (or short-selling), you are betting that the stock will go down in price. So, you borrow the shares at their current price to sell and hope that the price goes down. Then you can return the borrowed stocks (buy to cover) and you pocket the difference. Let’s see an example.

Example

If you shorted (borrowed) one share of Stock A when it was at $8, and bought to cover (returned) Stock A when it was at $5, then you made $3. But, if the price of the stock goes up, then you are losing money because you need to buy the stock at more than $8 to return the stock.

The Bad Guys

These big Wallstreet guys are called hedge funds, which basically are enterprises that are responsible for billions of dollars, investing them and driving the market. They started shorting the Gamestop stock until they reached a point that they had shorted the stock 260%, so 160% more than the actual stocks that were available on the market. They thought that, with all the power they had, they would make the stock’s price fall to the bottom. They thought wrong.

Fighting Back

When it became known to the r/wallstreetbets community that the Gamestop stock (GME) is the most shorted in the market and that the hedge funds are about to make billions in profits, well… that just didn’t sit well with them. So, they got to work.

Bye Bye Billions

People started buying more and more GME, driving the price increasingly higher. The more the price of the stock was increasing, the more the billionaires were losing money, and the more the internet was enjoying the show. For once, the ones who were getting the short end of the stick were the rich people.

Elon Takes Part

Even internet sensation and one of the world's richest man, Elon Musk, noticed the situation and posted a tweet about it. As it is normal after such a high-profile person talking about an issue, the stock price doubled in a few hours. But it wasn’t all sunshine and rainbows.

The Media

As we all know, the media is being run by small lobbies of billionaires that dictate public opinion. So, they started doing what they know best: they started blaming the people for their actions that were creating so much uncertainty in the market. And that wasn’t all.

The State By 27th of January

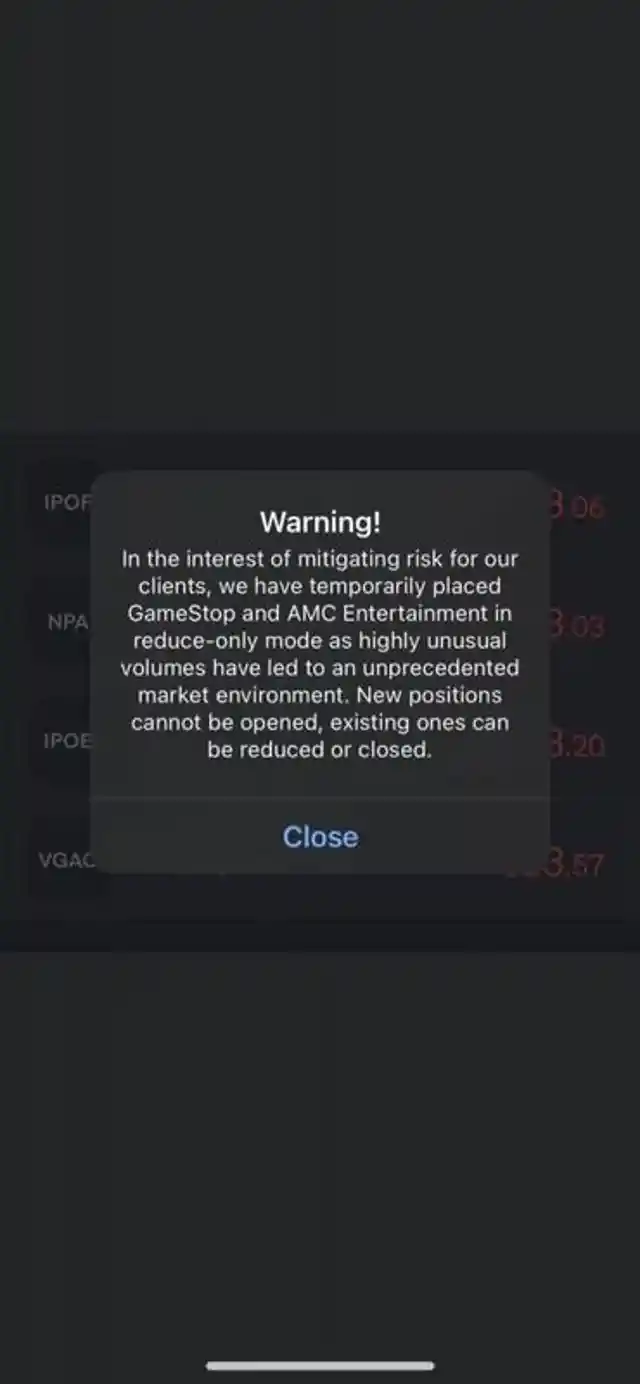

January 27th, 2021, was looking like another big day for Gamestop. However, the day became extremely chaotic as brokers, policy-makers, and hedge fund managers became increasingly worried. Multiple brokerages decided to put restrictions on the trading of Gamestop stocks and options. The White House said they were closely monitoring the situation.

The Stock Price Goes Down

As these things started happening, it spread fear, uncertainty, and doubt in the market and allegations of corruption of the brokerages. This naturally leads the price of the stock to plummet. But many people kept rebuying shares or refused to sell them. It was obvious this story was far from over. And then it began.

Robinhood

One of the biggest investing applications in the USA, Robinhood, was one of the platforms that was giving the average Joe, the ability to make the billionaires lose money. Many people were using it to buy stocks, driving the prices higher and generally having the time of their life. But that was all soon about to end.

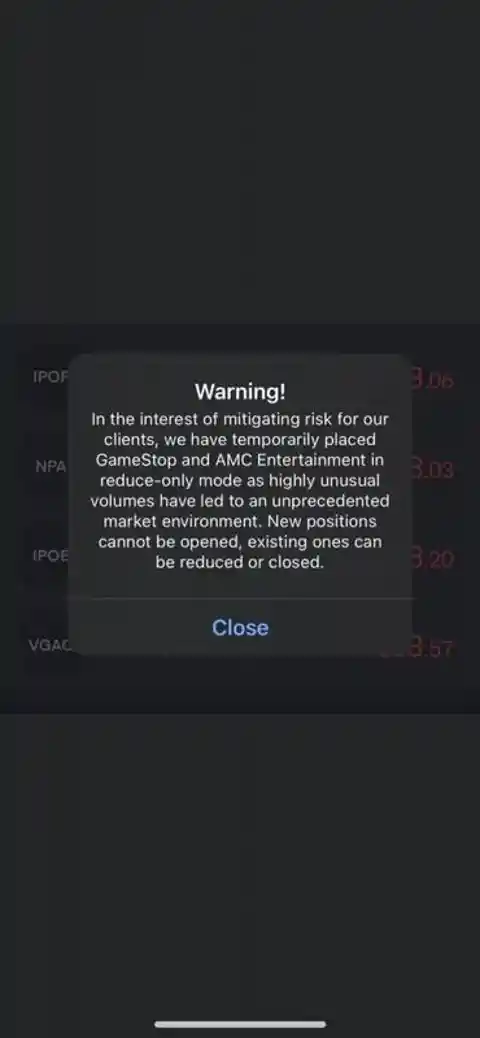

The Questionable Call

On January 28th, Robinhood, Interactive Brokers, and many other brokerages further put on the trading of Gamestop. Robinhood made it so that no one was able to buy Gamestop stocks or options—they could only sell it. This led Gamestop to fall 44% for the day: from $347 to $193.60. A dark day for the free markets.

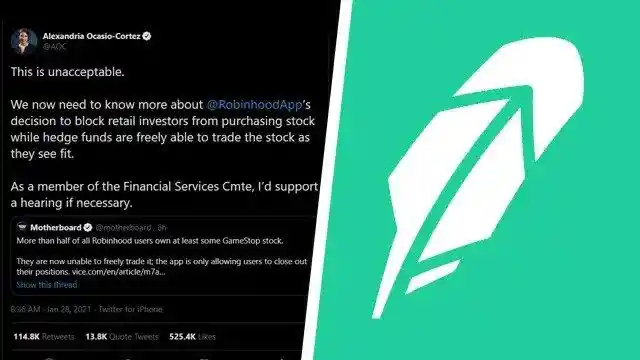

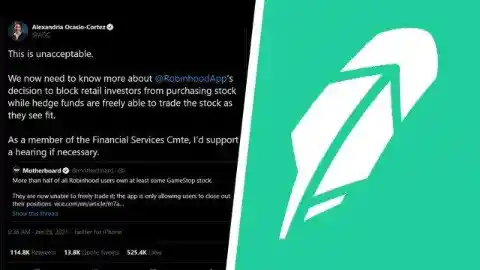

Political Reaction

This move was widely criticized by many, including both political parties. When Ted Cruz and AOC agree on something, you know you messed up big time. They all understood that it is unfair to put limitations on trading arbitrarily, while the hedge funds were free to buy and sell as they please. Doesn’t sound like a free market to me. Robinhood decided to respond.

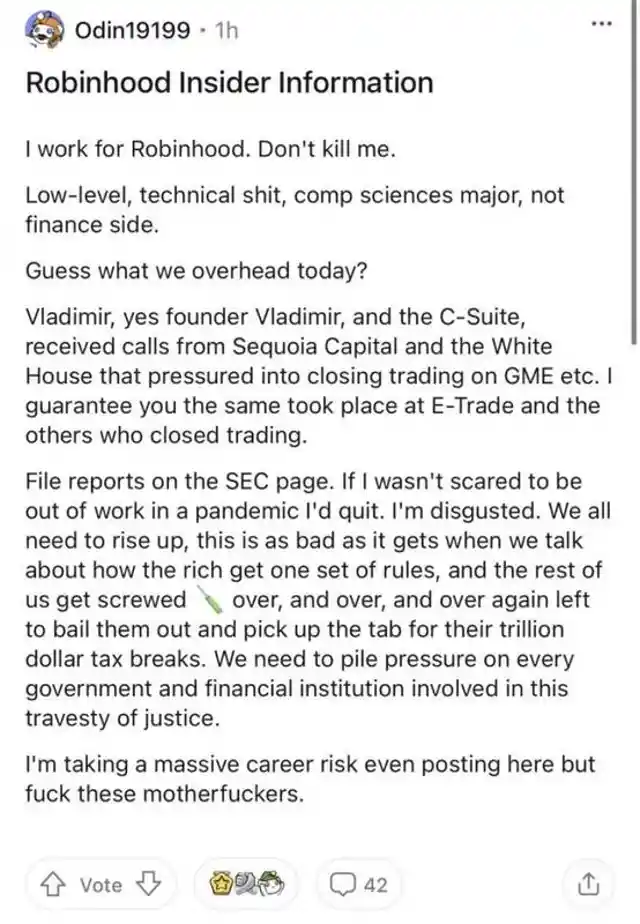

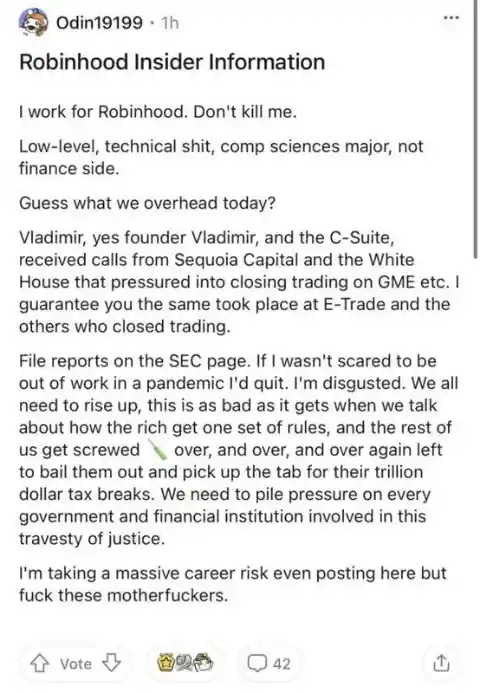

The Revelation

Although Robinhood said this was done out of caution for its users, a supposed Robinhood employee wrote on Reddit that this was not so. He stated that it was plain corruption. I don’t think anyone would be surprised if the allegations turned out to be true. Most people know that the White House is working for the privileged people and not for all citizens. That’s why they did the only thing they could do.

Fighting Back

They started complaining about Robinhood's decision with many people going to their lawyers to see how they can settle this issue legally. Many lawsuits have been filed against the company for breaching its contract by failing to disclose that it “was going to randomly pull a profitable stock from its platform.”

The Power Is Back

But it wasn’t until the end of the day that Robinhood decided to allow limited trading of the stock again. It is not clear why this was done. The best guess we have is that Robinhood got scared of the major outcry of the public and the potential implications it might have. But the implications might still come.

Investigating Robinhood

The US Securities and Exchange Commission is signaling it's going to investigate Robinhood for blocking users from buying shares in GameStop and seven other stocks. Several other platforms did the same and they will face similar procedures. This is another victory for the little guy.

The Corrupt Media Blaming The People

The media keep blaming the people of Reddit and the small investors that are creating volatility in the market presenting the billionaires as the victims of this situation. Thanks to the power of the internet though everyone can see for themselves that it’s not the small investors that are at fault, since what they are doing is legal. You won’t believe the real reasons behind this incident.

The Reasons

As you might know, thanks to the coronavirus pandemic. Millions of people have lost their jobs, are working in inhuman conditions, or are in danger of losing their job since the economy is not doing well. The coronavirus pandemic has been, for the majority of people, a huge financial danger. But not for all of them.

More Reasons

The top ten richest people in the world have gained enough money to buy whole countries thanks to the pandemic. Especially the companies that are related with good distribution (such as Amazon) are doing exceptionally well. When the whole world is suffering, the ones that already had too much are gaining more and more. With the people of the internet, that doesn’t sit well.

The New York Times’ Blaming

One of the most famous news agencies, The New York Times, made a post that suggested that the amateur investors were propelled by a mix of greed and boredom. Of course, Reddit took this post and did the best it could to show the real colors of mainstream media. The answer was hilarious.

The Hilarious Response

There is indeed great hate between everyday people and the Wallstreet. Everybody knows that it’s a rigged game for the rich people to earn more money, but nobody knew what to do until now. They seemed to be unbeatable. The answer was more simple than anyone would have thought. Known to many people since ancient times.

Why People Should Stick Together

When the people stick together, they are stronger. This is what became clear from this story. The hedge fund thought that it could exploit people and control the market whichever way they wanted. But some “degenerates”, as they call themselves in the subreddit, managed to make them feel some pain. Although there is a real danger coming.

The Battle Is Still Happening

Now that the “degenerates” of the world have won the first battle, they are trying to win the war. If people start selling their shares, and panic follows, the hedge funds are going to win, since some of the shorts will still be possible. So there is a huge campaign happening now telling people to HOLD their stocks until the prices increase more and more, causing further damage, to the Wallstreet. Just to teach them this crazy lesson.

A Clear Message

“You can’t mess with us! The game is over for you”. The people realized that they have the power if they unite together. Millions and millions around the world are shouting the same message. In the end, the thing that united the people was a common enemy. I guess the saying “the enemy of my enemy, is my friend” was put into action in a global scale. But there is still more fighting to be done.

The Modern Age Revolution

With this modern age revolution going on at the moment, nobody can guess what its effects will be, but one thing is for sure. The stock market will take a long time to forget this lesson, and if it does, the people are here to revise it.