Kluge Family- $6 Billion

Do you ever wonder HOW those billionaires made so much money? Was it inherited, did they earn it all themselves, what industry could possibly make someone so much money? Here, we have revealed the richest families in the U.S.

along with the stories behind their wealth and even the family feuds that took place over the money. You might be surprised to find out which industries can make people billions of dollars.

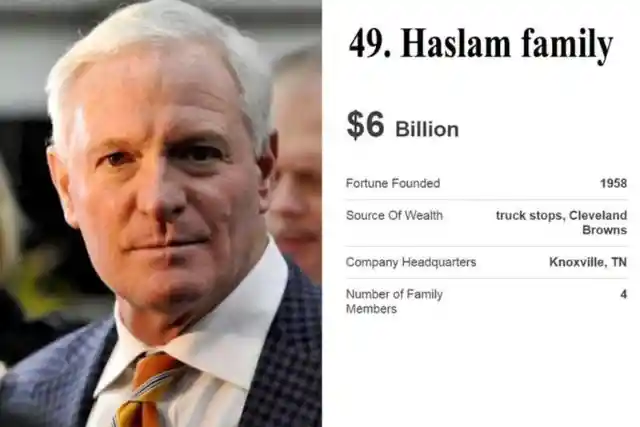

Haslam family- $6 billion

His son, John Kluge Jr., is also a Columbia graduate and active philanthropist; his angel investment firm, Eirene, is focused on solving sanitation issues through its Toilet Hackers program. His siblings Samantha and Joseph Kluge share the inheritance.

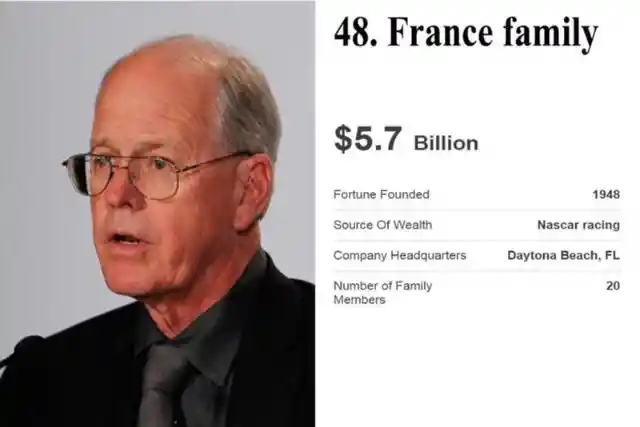

France family- $5.7 billion

In April 2015, Pilot settled with 4 trucking companies not part of the class-action settlement. CEO Jimmy Haslam, the founder’s oldest son, has denied any knowledge of the rebate fraud scheme. In 2012 the family (excluding Gov. Bill Haslam) bought the Cleveland Browns football team for a reported $1 billion. Daughter Ann Haslam Bailey has no role at the company.

Smith family

Current ISC chief executive Lesa France Kennedy is Brian’s older sister; she was married to a plastic surgeon, Dr. Bruce Kennedy, who died in a dramatic plane crash in 2007. Their son, Ben, is a driver with Red Horse Racing, as was his cousin, J.C. France (Jim’s son)- formerly with AX Racing. Twenty family members own shares in publicly traded International Speedway Corp.

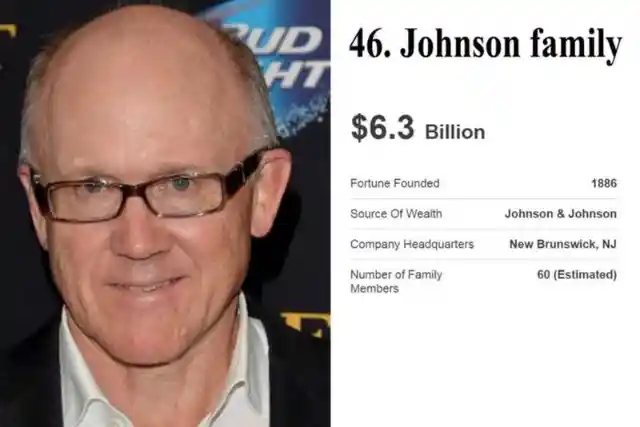

Johnson family- $6.3 billion

More than 100 years later, his descendants still have massive stakes in both companies. Byron’s great-grandson Harold Smith stepped down as president of Illinois Tool Works in 1981. The fifth-generation scion David Smith Jr., a lawyer and former regulator with the SEC, serves on the boards of both Northern Trust and Illinois Tool Works, which are still two of the city’s largest companies.

Phipps family- $6.6 billion

The General left much of his fortune to the Robert Wood Johnson Foundation, which today has assets of $10.2 billion and is the largest philanthropic organization dedicated solely to health. The rest went to his heirs, the most famous of which is grandson Woody, the much-maligned owner of the New York Jets. Outside of the Jets, Woody’s fortune is hidden in an extremely private New York investment company called the Johnson Company. Woody’s ex-wife told family biographer Jerry Oppenheimer that even she never knew how much money her ex-husband had. Forbes went with a conservative estimate, but it is possible that the Johnson family has more than the $6.3 billion we pinned down.

LeFrak family- $6.6 billion

Bessemer, which started accepting money from outside clients in 1974, has since grown its asset base to nearly $100 billion; it is chaired by Henry Phipps’ great grandson, Stuart Janney, III. The family also has a strong presence in the world of horse racing, having won the 2013 Kentucky Derby with their thoroughbred Orb. Ogden Phipps was Chairman of the Jockey Club for ten years before passing on the torch to his son, Dinny, who remains in charge to this day.

Jenkins family- $6.8 billion

His son Sam entered the family business and helped fuel massive expansion as the post-War construction boom flourished. Now with Sam’s son, Richard, in charge and his sons involved, the LeFrak Organization has evolved further, adding properties in California and Washington State, and investing in natural resources through oil wells and mineral rights. Still it is best known for its New York City metropolitan area properties, including the 5,000-unit apartment complex LeFrak City in Queens and more than 16 million square feet of commercial, residential and retail properties in Newport, NJ (including Forbes’ new home) across the Hudson River from lower Manhattan.

Marriott family- $6.9 billion

The Jenkins family still runs Publix, which did more than $30 billion in sales in 2014. George’s nephew, Charlie Jenkins Jr., is chairman, and his grandson, Ed Crenshaw, is the fourth family member to occupy the CEO role. George’s daughter, Carol Jenkins Barnett, is president of Publix Super Markets Charities. Altogether the family owns 20% of the retailer, while employees hold the remaining 80%. Five family members sit on the Publix board of directors.

Cathy family- $7 billion

Younger son Richard has run Host Hotels & Resorts since 1993, the year his older brother Bill spun the company off from the family’s Marriott International amid bondholder protests. The Marriotts are devout Mormons. Through their companies, they are strong supporters of gay and LGBT rights.

E.W. Scripps family: $7.2 billion

That’s the result of a cult-like following beginning in 1946, when Truett Cathy and his brother Ben (d. 1949) were first serving their chicken sammies to Ford factory and airport workers around the clock. The Cathy family is as known for chicken as for the business’ Christian values. Stores close on Sundays, and employees and franchisees are advised “to base your business in biblical principles.”

Chao family- $7.2 billion

Scripps merged with Journal Communications in April 2015, keeping the broadcast TV stations but spinning out their combined newspaper assets into a new company called Journal Media Group.The close-knit Scripps family, which gets together for meetings at least twice a year, controls two-thirds of the board seats for both E.W. Scripps and Scripps Network Interactive (both are publicly traded), though it’s not involved in day-to-day management. Scripps family members vowed decades ago to avoid divisiveness, for the good of the family and the company. An estimated 60 family members share the fortune.

Bechtel family- $7.3 billion

2008) moved his family from mainland China to Taiwan in 1946. More than three decades later, he relocated his family to the U.S. where T.T., and his two sons James and Albert quickly began acquiring chemical plants in the Southeast corridor. Eldest son James is Westlake’s chairman; Albert is CEO. With sister Dorothy Chao Jenkins, siblings own 35% of the company.

Rollins family- $7.4 billion

In early June, it completed the tunneling under London for Crossrail, a new high capacity railway that is the largest engineering project in Europe. Fourth generation Riley Bechtel stpped down as CEO in 2014, due to health reasons, but remains chairman. His son Brendan is president and COO of Bechtel, which now has $37 billion (sales).

Simplot family- $7.5 billion

Wayne Rollins’ grandchildren suing their father and uncle Gary (Rollins Inc CEO) and Randall (chairman) for what they claim is their rightful inheritance. Rollins Inc subsidiary Orkin, the termite killing franchise, remains the family’s best known business, although their stake in oil and fracking spin-off RPC Inc is also worth billions.

Simon family- $7.7 billion

Shortly before Simplot’s death in 2008, his company was supplying one third of America’s french fries. The Simplot company has expanded into phosphate mining and fertilizer production via JR Simplot Co. His three children have run the $5.8 billion (sales) company since his death.

Pigott family- $7.7 billion

Melvin’s son, David, has been CEO since 1995. Herb also owns the Indiana Pacers, which he bought with his brother; the team’s value has doubled in the past year. Herb also sits on the board of the Cheesecake Factory. He is a father of eight and on his third marriage–this time to a former Miss Universe from Thailand.

Stryker family- $7.9 billion

Mark Pigott stepped down from his role as CEO in late 2013, but remains active as Paccar’s executive chairman. Pigott, who is also a member of the Augusta National Golf Club, is the president of the Paccar foundation which has made more than $160 million in donations to education, social services, and the arts.

Meijer family- $7.9 billion

Jon and Patricia are influential in Democratic national politics. Jon was an early donor to Ready for Hillary, a super PAC that encouraged Hillary Clinton to run for the White House. He also founded the Arcus Foundation to promote gay and lesbian causes. Patricia runs the Bohemian Foundation, which supports the arts and education.

Hughes family- $7.9 billion

The brothers remain co-chairman of the $15 billion (estimated sales) company, which now has more than 200 stores in six Midwestern states, including big-box stores and also smaller Meijer Marketplaces. In June 2015, Meijer opened its first stores in Wisconsin.

Shoen family- $8 billion

sit on the Public Storage board. All three are individual billionaires. Well known in the thoroughbred racing world, B. Wayne Sr. spends much of his time on his 700-acre Spendthrift Farm in Kentucky. He’s also an avid supporter of conservative politics and causes as well as the founder of American Commercial Equities, which is engaged in the acquisition and operation of commercial properties in California and Hawaii.

Bass family- $8.2 billion

and eldest son Samuel diversified into rentals of everything from video tapes to jet skis. Profits plummeted and younger brothers Joe and Mark orchestrated a boardroom coup in 1987. Joe became chief (and still is today) and returned U-Haul to truck rentals and, subsequently, prosperity. Not long after Joe took the helm, the fractured family took its squabbles to the courts and remained in nearly constant litigation for 25 years. At one point, L.S. Shoen accused his estranged sons of taking part in the murder of Samuel’s wife in 1990 before a paroled rapist confessed. L.S Shoen committed suicide in 1999. The last of the litigation concluded in 2012.

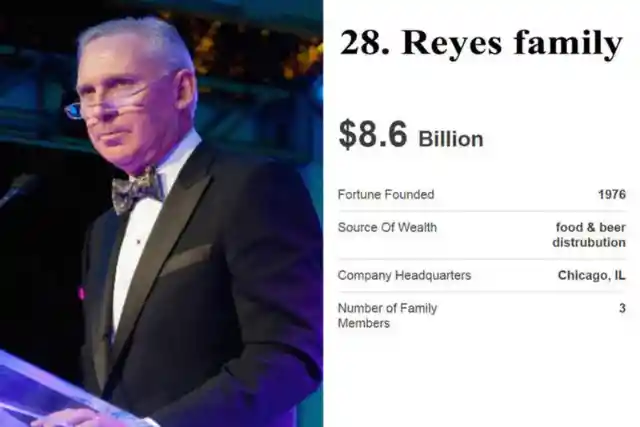

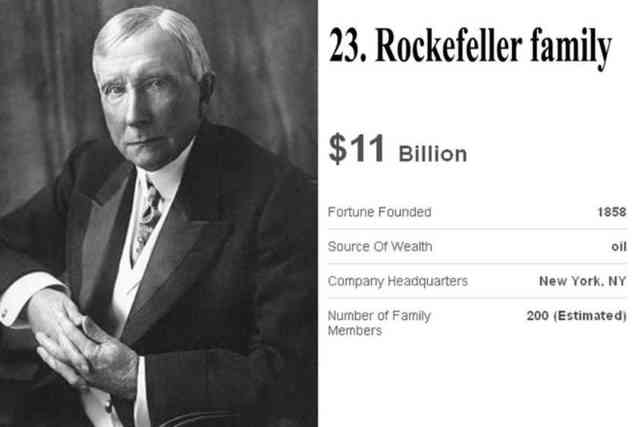

Reyes family- $8.6 billion

She and her husband Perry (d. 2006) celebrated their 50th wedding anniversary by giving away $1 million to 50 different charities. Their collective fortune took a hit from the global rout in oil prices that has put pressure on fracking and domestic oil and gas production.

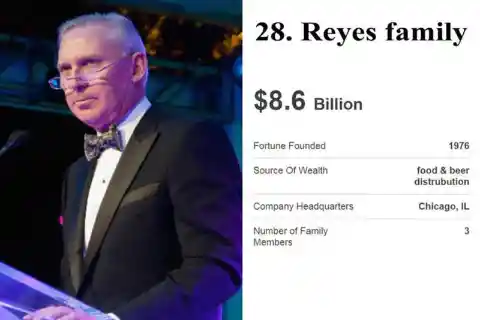

Crown family- $8.8 billion

Jude Reyes are majority owners and co-chairs of the $23.5 billion(sales) company. Brother David “Duke” Reyes is the CEO of Reyes Beverage Group and owns a minority stake. Brothers James and Tom are executives at Reyes Beverage Group while brother William is a director of Reyes Holdings.

Marshall family- $9 billion

Henry merged his building-supplies company with General Dynamics in 1958. The Crown family still owns 10% of General Dynamic stock, worth some $4.8 billion at press time and the family’s largest single asset. Henry Crown remained an active investor and financier until his death in 1990. An estimated three family members share the fortune.

Gallo family- $10.3 billion

and got his Koch Industries stock in the 1950s when Koch acquired an interest in Great Northern Oil. E. Pierce died in 2006, leaving the Koch Industries stock in trust with his wife Elaine as income beneficiary. The family has spent millions on lawyers thanks to J. Howard II’s financial and romantic adventures, including a May-December marriage to former Playmate Anna Nicole Smith. In 2014 the Fifth Circuit Court of Appeals largely affirmed the government’s tax claim against the family over J.Howard’s attempt to transfer the Koch stock at an unrealistically low value.

Butt family- $10.4 billion

1993) ran E&J Gallo Winery for six decades: Julio grew the grapes, and Ernest sold them. Five-foot-four-inch Ernest was known for his swagger; he would force distributors to keep growing or threaten to take Gallo’s business elsewhere. More then a dozen children and grandchildren still run the wholly family-owned business, which has an estimated $3.8 billion in revenues, from the same fertile land in California. Wine brands include Gallo Family Vineyards, Barefoot Cellars, Frei Brothers and William Hill Estate. The company has expanded into liquor with New Amsterdam gin and vodka and Familia Camarena tequila.

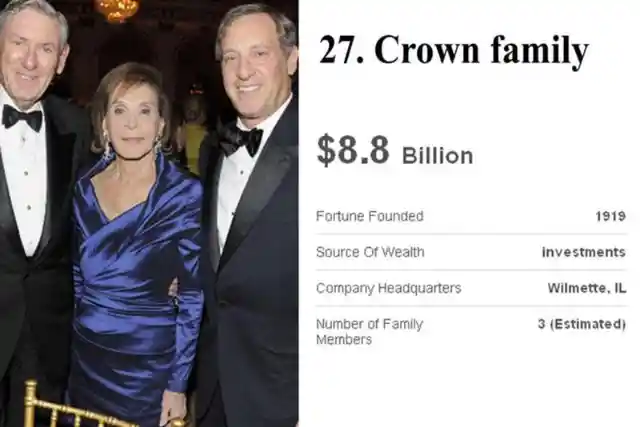

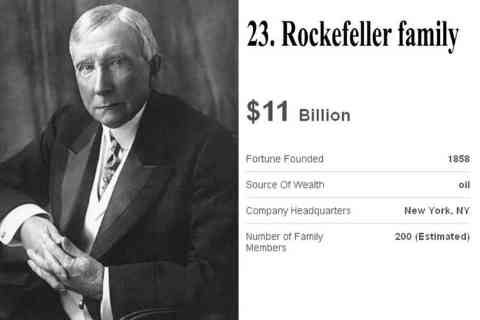

Rockefeller family- $11 billion

He has run the company, H.E. Butt, since 1971 and is the majority shareholder. His two siblings and two nephews also own stakes in the $20 billion (estimated sales) business, which has 316 stores in Texas and 52 in Mexico.

(Don & Doris) Fisher family- $11 billion

John Jr. built Rockefeller Center. His grandson David — who had a long career with Chase National Bank — is the world’s oldest billionaire; he turned 100 in June. A devoted art patron, David still travels the world visiting museums, and his personal collection includes works by Monet, Picasso and Van Gogh.

Mellon family- $11.5 billion

Today the $16 billion (sales) giant operates about 3,700 stores globally under brands that include Old Navy, Banana Republic and Athleta. The family still owns a 43% stake, and two of the couple’s three sons (Bill and Bob Fisher) sit on Gap’s board. The company announced in June 2015 that it would be shuttering 175 stores and laying off 250 employees amid sluggish sales. In 2000, Donald and Doris cofounded the KIPP Foundation, which supports a network of charter schools; son John Fisher remains its chairman.

Brown family- $12.8 billion

1937) was a turn-of-the-century venture capitalist, investing in companies that became Alcoa and Gulf Oil. Later generations haven’t hit grand slams like those, but are still actively building businesses. Andrew’s grandson, Timothy, owns a New England railroad company. His grandnephew Richard Scaife, who owned a media company in Western Pennsylvania that includes Pittsburgh’s Tribune-Review, died in July 2014, leaving much of his fortune to charitable foundations (which Forbes does not count toward the family’s net worth). Matthew Mellon, an entrepreneur and investor in cryptocurrency startups like Ripple Labs, is now the face of the family.

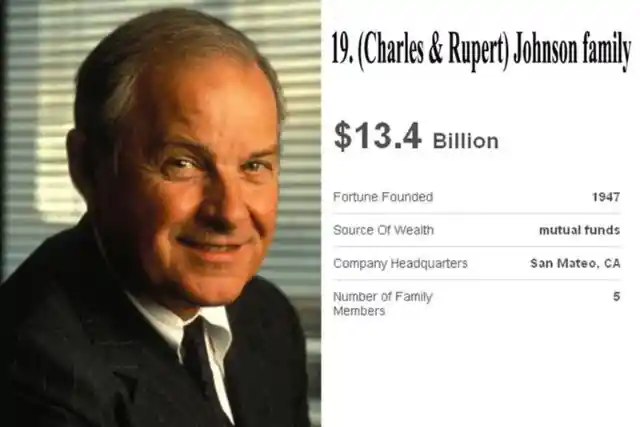

(Charles and Rupert) Johnson family- $13.4

The company also produces Finlandia vodka and Herradura tequila. The Browns own an estimated 51% of the publicly traded firm; George Garvin Brown IV, a member of the fifth generation, chairs the Brown-Forman board. At least 25 family members share the fortune.

Busch family- $13.5 billion

Charles’ son, Gregory, is chairman and CEO, and his daughter, Jennifer, is COO. Rupert Jr. is vice chairman. The family owns about 35% of publicly traded Franklin Resources. Charles also has a large stake in the San Francisco Giants baseball team.

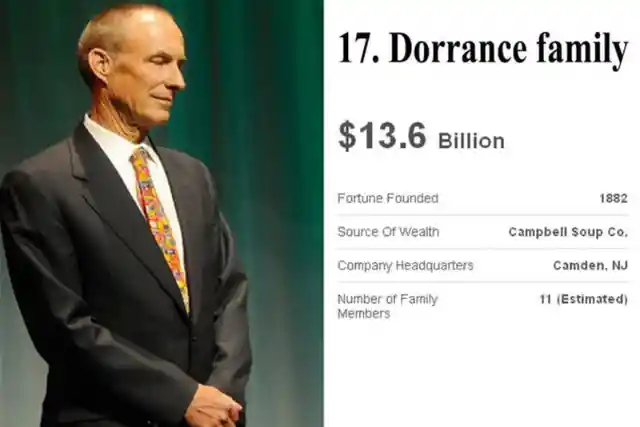

Dorrance family- $13.6 billion

Roosevelt repealed Prohibition, August reportedly sent a 24-beer crate to the White House. The family passed down the company through the generations but ended up selling an estimated 25% of the business from 1989 to 2008, leaving the family powerless to stop the $52 billion buyout bid. Seven years later, a branch of the Busch family is back in the beer business, albeit on a much smaller scale. Billy Busch founded William K Busch Brewing in 2011 with two lagers, Kraftig and Kraftig Light. Until recently, its beers were only distributed in Missouri and Illinois — but Billy insists it isn’t a micro-brewery and announced a major expansion into Texas in 2015.

Sackler family- $14 billion

Malone and Bennett Dorrance, as well as great-grandson Archibold D. van Beuren, sit on the board today. Charlotte Colket Weber, cousin of Malone and Dorrance and a devoted equestrian, stepped down at age 72 in November 2014 due to age limits. Heir John Dorrance III renounced his U.S. citizenship and moved to Ireland before cashing out his 10.5% stake nearly 20 years ago, reportedly to avoid capital gains taxes. Campbell Soup is now a global giant with more than $8.3 billion in revenues and brands such as Prego and Pepperidge Farm.

Hunt family- $14.2 billion

The company paid more than $600 million in 2007 to settle charges with federal prosecutors that it had misbranded OxyContin as safer and less addictive than it was. Today, the company — still 100% owned by the Sackler family — generates more than $3 billion in sales in U.S., mostly from OxyContin. Separate Sackler-owned companies with similar products generate just as much money selling to Europe, Canada, Asia and Latin America. Purdue is once again facing a potentially enormous legal bill: a civil lawsuit by the state of Kentucky could reportedly yield damages in excess of $1 billion. Purdue denies wrongdoing in this case, noting that courts across the United States have dismissed similar cases against Purdue because evidence failed to establish the company’s marketing caused the alleged harm. An estimated 20 family members share the fortune.

Du Pont family- $14.5 billion

Today his descendants oversee discrete fortunes: Son Ray Lee oversees Hunt Oil; son William Herbert is a big player in shale; and daughter Caroline founded and later sold Rosewood Hotels & Resorts. His late son, sports magnate Lamar Hunt, is said to have named the Super Bowl, and his children still own the Kansas City Chiefs. In October 2014, his son Nelson Bunker Hunt, who tried to corner the silver market in the 1970s with brother William Herbert, died at age 88.

Ziff family- $15 billion

du Pont on the company’s board of directors. Pete du Pont was governor of Delaware from 1977-1985 and ran for president in 1988. Du Pont heir Robert Richards made national news in March 2014 when it came out that he had previously pled guilty to raping his three-year-old daughter. He was not the first member of the family to get in trouble with the law. In 1996 John E. du Pont murdered Olympic gold medal wrestler David Schultz. The story was retold in the 2014 film Foxcatcher, which was produced by another heir, Megan Ellison, daughter of billionaire Larry Ellison.

Lauder family- $16.5 billion

first started his publishing business. Their father William Jr. built up Ziff Davis, which became best known for such trade publications as PC Magazine and Car and Driver, before selling it for $1.4 billion in 1994. The brothers who got the proceeds have since increased those proceeds tenfold.

Newhouse family- $18 billion

The Lauder family together controls 77% of the company’s voting power. Estee Lauder’s son Ronald, who is also the former U.S. ambassador to Austria and served as chairman of the cosmetics company, has recently spent time advocating for Jewish rights in the U.S. Congress and speaking out against antisemitism. Both Ronald and Leonard have also made names for themselves as impressive art collectors.

Duncan family- $22.4 billion

Si and Donald inherited the company from their father, Sam Newhouse (d. 1979), who started out with one newspaper in New Jersey. Si reportedly stepped down from managing the magazine side of the business in 2011, but remains chairman. Donald oversees the newspaper division, which has over 30 editions including The Times-Picayune in New Orleans and The Plains Dealer in Cleveland. Donald’s son, Steven, is responsible for day-to-day management of the newspapers.

(Edward) Johnson $26 billion

The family fortune has since more than doubled, thanks to generous dividend payouts and a rise in the stock price of pipeline behemoth Enterprise Products Partners. Randa, the eldest, is chairman of the board. Scott, 32, is the youngest American billionaire to have inherited his wealth.

S.C. Johnson- $28.8 billion

His son, Edward “Ned” Johnson III, ran the company from 1977 until last year when he stepped down as CEO. He remains chairman of the board. Ned’s daughter Abigail replaced him as Fidelity CEO in October 2014. Ned’s son Edward Johnson IV runs a family-owned real estate company. Another daughter Elizabeth is not involved at Fidelity.

Pritzker family- $30 billion

Ownership of SC Johnson was divided 60-40 between his two children, Herbert Fisk Jr. and Henrietta Johnson Louis. Their descendants still own 100% of the $9.6 billion (estimated sales) company. Today, Herbert Fisk III, great-great grandson of the founder is CEO.

Hearst family- $32 billion

Altogether there are 11 individual billionaire members of the family. Roots of the fortune date to A.N. Pritzker (d. 1986), who with his sons Jay and Robert created Hyatt Hotels and invested in holdings like industrial conglomerate Marmon Group, now owned by Berkshire Hathaway.

Cox family- $34.5

Two years into the leadership of CEO Steven Swartz, the Hearst Corporation continues to grow, delivering record revenues north of $10 billion, while investing in up-and-coming media outlets like Vice and BuzzFeed. Over the years, the family had its fair share of scandals, from the kidnapping of Patty Hearst by a guerrilla group in the 1970s, to a nasty divorce between the late John R. “Bunky” Hearst Jr. and his wife Barbara that revealed some of the inner workings of the family’s secretive trust.

Cargill-MacMillan family- $45 billion

In June 2015 it announced a $4 billion deal to acquire publicly traded DealerTrack, a maker of software for car dealerships. Through Cox Enterprises, the family already owns AutoTrader.com, Kelley Blue Book and Manheim car auctions. The fortune is divided between James Cox’s daughter, Anne Cox Chambers, and his grandchildren, James Kennedy and Blair Parry-Okeden; Kennedy chairs Cox Enterprises and served as its CEO from 1988 to 2008.

Mars family- $80 billion

He got rich as railroads expanded westward at the end of the century, turning the Great Plains into America’s bread basket. Cargill’s son-in-law, John MacMillan, took over the business in 1909. The final member of the family to serve as CEO, Whitney MacMillan, stepped down in 1995. Today only six members of the family sit on Cargill’s 17-person board, thanks to an agreement between family factions in the mid-1990s. The family leaves 80% of the company’s net income inside the company for reinvestment each year.

Koch family- $86 billion

Mars also makes Uncle Ben’s rice and owns pet food brands Pedigree and Whiskas. Jacqueline is a trustee of the U.S. Equestrian Team and sits on the board of directors of the National Sporting Library and Fine Art Museum. Forrest is interested in historical preservation and is a trustee of the Colonial Williamsburg Foundation. John and his wife Adrienne are noted supporters of the Fred W. Smith National Library for the Study of George Washington at Mount Vernon.

Charles and David plan to be big spenders in the 2016 elections through their various conservative organizations. Charles told USA Today in April he and his 450 wealthy followers plan to spend $300 million on the elections over the next two years.