1. Spain's Princess Christina

A Spanish judge charged Princess Cristina - younger daughter of King Juan Carlos - with tax fraud and money laundering, possibly paving the way to an unprecedented trial of a member of the royal family.

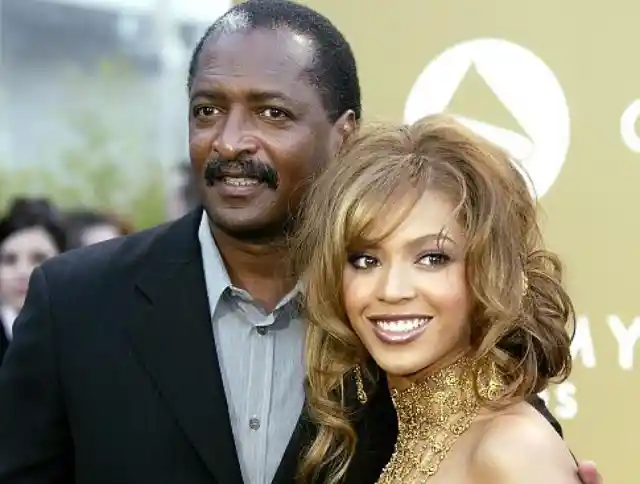

2. Matthew Knowles

Beyonce’s Dad, and former Manager, has made a lot of money off his daughter’s career in the past but unfortunately Uncle Sam wants some of it too. The IRS filed a lien against Mr.

Knowles for unpaid taxes for 2010 & 2011 to the tune of $485,575.95 & $728,004.89 respectively.

3. Inaki Urdangarin

The princess's husband, former Olympic handball player Inaki Urdangarin, has been charged with fraud, tax evasion, falsifying documents and embezzlement of 6 million euros ($8 million) in public funds through his charitable foundation which put on sports business conferences in Mallorca and elsewhere in Spain.

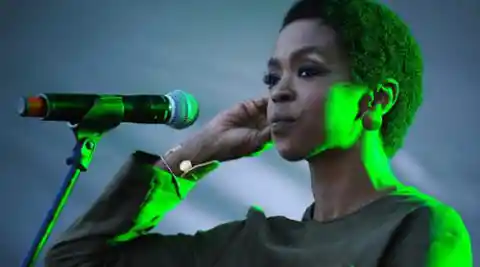

4. Lauryn Hill

Perhaps most famous for her work with band the Fugees, Grammy Award-winning Lauryn Hill is a successful singer, rapper, songwriter, record producer and actress. Although her musical output has been sporadic over the past decade, she made a return to regular live performance in 2010. However, only two years later, she was charged with three counts of failing to pay taxes on $1.8 million earned between 2005 and 2007. Hill pleaded guilty and on May 6, 2013 she was sentenced to three months of prison time, followed by three months of house arrest and a further period of supervised release.

Her sentence also considered additional unpaid taxes from 2008 to 2009, plus taxes owed to the state of New Jersey. “I was put into a system I didn’t know the nature of,” Hill says. “I’m a child of former slaves. I got into an economic paradigm and had that imposed on me.” Regardless of people’s personal beliefs, everybody has to pay taxes, and accountants can help ensure that clients do not make any slip-ups.

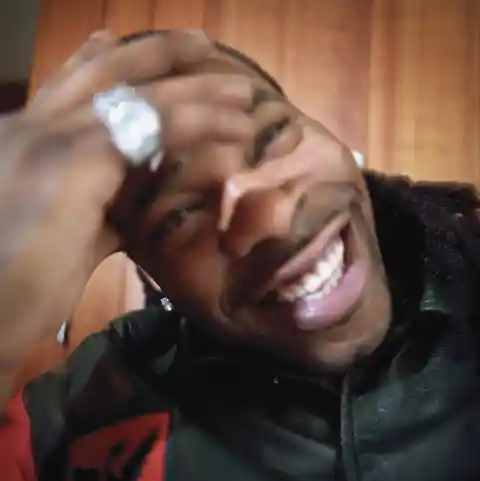

5. Ja Rule

Jeffrey Atkins, aka Ja Rule, is a Grammy nominated rapper and singer from Queens, New York. As well as his rap career, Ja Rule has acted in numerous movies, including 2001’s The Fast and the Furious. Unfortunately, he is not a stranger to legal troubles and has spent time behind bars for “attempted possession of a weapon,” for which he was sentenced to two years in prison in 2010. In July 2011, he was handed a concurrent 28-month sentence for not paying taxes on money earned between 2004 and 2006 (earnings which amounted to approximately $3 million).

Besides being deprived of his liberty, he was also required to pay $1.1 million in back taxes – and that’s excluding IRS penalties). Apparently, Ja Rule claimed that he didn’t mean to do anything wrong – he was simply young, naïve, and earning a lot of money. On May 7, 2013, the rapper completed his sentence early, and hopefully he’s learnt that it’s better to pay your dues up front. Perhaps he should have listened to his accountant, who had previously warned him that not paying taxes is a punishable offence.

6. Phil Driscoll

Grammy Award-winning musician Phil Driscoll, most well known for his trumpet playing, has been recording music since the early ‘70s. His music spans a wide range of genres, including classic rock, gospel, jazz and pop. In 2006, things took a turn for the worse when he was accused of conspiring with his wife Lynne and her bookkeeper mother to avoid paying $128,627 in taxes from 1996 to 1999. On June 8, 2006, the star was found guilty on two counts of evading tax and one count of conspiracy.

Driscoll was punished with a year’s sentence in federal prison, starting March 14, 2007. After his sentencing, Driscoll, whose unpaid tax quantity was reduced to between $30,000 and $80,000, claimed that he didn’t mean to steal money from the US government. Lynne was acquitted of conspiracy charges and the tax evasion charges against her resulted in a hung jury. Lynne’s mother died before the trial.

7. Ron Isley of the Isley Brothers

In 2005, Ronald “Mr. Biggs” Isley, founder and lead singer of The Isley Brothers, was convicted on five counts of tax evasion and one count of willfully failing to file his taxes. At a 2006 hearing, Isley’s lawyer Anthony Alexander argued that his client should be treated with leniency due to his pre-existing health issues. On top of his three years and one month sentence (the maximum sentence could have been as long as 26 years), Isley was instructed to pay $3.1 million to the IRS. According to Alexander, several “unfortunate circumstances” had left Isley powerless to pay his taxes.

Apparently, two of his accountants had died, which made it very difficult for him to find the records he needed to pay the taxes. The judge was unsympathetic, saying, “The term serial tax avoider has been used. I think that’s appropriate.” Isley served his time at the Federal Correctional Institution in Indiana, before being moved to a halfway house later in his sentence. He was released in April 2010. Interestingly, Isley is listed as one of the worst taxpayers in the state of California.

8. Beanie Sigel

Dwight Grant, better known as Beanie Sigel, is a Philadelphia-born rapper who has worked with Roc-A-Fella Records, the Dame Dash Music Group, and G-Unit Records. He has sold over two million records across the globe and has even dabbled in acting. Sigel has been caught on the wrong side of the law a number of times, and tax evasion has probably been the most devastating in terms of prison time and fines. Sigel was accused of not paying taxes from 1999 to 2005 (excluding one $10,000 payment in 2001) and was estimated to owe the IRS $728,536 in taxes based on the $2.2 million he made during that period.

Sigel pleaded guilty, but due to the statute of limitations he only faced tax evasion charges between 2003 and 2005. He went to prison in late August 2012 and is currently serving 24 months of jail time at Philadelphia’s Federal Detention Center. In 2013, Sigel was sentenced to a concurrent six to 23 months for possession of illegal prescription drugs.

9. Roy Wooten AKA Future Man

Roy Wooten, also known as “Future Man,” “RoyEl,” and “Futche” to his fans, is a five-time Grammy Award-winning musician. Wooten is most famous for his role as a percussionist with jazz-fusion quartet Béla Fleck and the Flecktones, but he is also a solo artist. The eccentric musician also invented the Drumitar and a keyboard-like instrument based on the periodic table known as the RoyEl. In November 2001, Future Man’s future began to look a little less bright when he was indicted on four counts of tax evasion. According to authorities, Wooten falsely claimed that he was exempt from paying income tax from 1995 to 1998.

He eventually pleaded guilty to one count of tax evasion, while the other three charges were dropped. Fortunately for him, the sentence was relatively light. On August 8, 2005, Wooten was sentenced to two years’ probation and ordered to pay roughly $131,000 in back taxes. He was also allowed to continue traveling and playing with his band.

10. Fat Joe

Rapper and businessman Fat Joe, real name Joseph Cartagena, has had many an achievement in the music industry, but he has been less successful when it came to paying his taxes. In December 2012, Fat Joe pleaded guilty to two counts of tax evasion relating to the money he earned between 2007 and 2008. According to The Huffington Post, the charges could amount to $200,000, with penalties on top. Originally, the government accused the rapper of failing to pay taxes on money earned between 2007 and 2010, estimated to amount to $718,038 in back tax.

Fat Joe has yet to be sentenced, and the initial accusation will be taken into consideration – he could face up to two years in prison. In an interview on MTV’s RapFix Live, broadcast on May 22, 2013, Fat Joe blamed his financial advisers and accountants for his troubles. “You gotta understand we hire guys who are supposed have Harvard degrees to take care of us,” he explains. “…Then you always see an artist or a celebrity or somebody like that going down for it and these guys never go down for it.” Although it may be easy for clients to blame their accountants when things go wrong, perhaps they should consider paying closer attention to their finances so they can flag up any issues before they become problematic.

11. Mystikal

New Orleans-born rapper Michael Lawrence Taylor, aka Mystikal, also moonlights as an actor. In August 2005, while he was serving a six-year sentence for sexual battery and extortion, Mystikal faced federal charges for not filing tax returns in 1998 and 1999. A federal court convicted the star on January 12, 2006 and sentenced him to one year behind bars, which he was allowed to serve alongside his six years of state time. Imprisoned at Louisiana’s Elayn Hunt Correctional Center, Mystikal’s federal sentence expired on January 11, 2007. Then on January 14, 2010, he was finally released.

Mystikal, who has also had to register as a sex offender, admits that he “disconnected” from the rap scene while in prison. He had this to say after his release: “I was gone so long, all the things I achieved, all the accolades I attained, it felt like it was a dream. It felt like I’d never done that stuff. But watch how I shake this world up now – I want reparations.” Still, it wasn’t long before Mystikal was behind bars again, this time for violating his probation after a domestic battery charge in 2012.

12. Method Man

Clifford Smith, more widely known as Method Man, is a Grammy Award-winning rapper and actor from Long Island, New York. Given his stage name, you’d think the Wu-Tang Clan member would be more methodical when it came to filing his tax returns. According to the state of New York, Method Man didn’t send in tax returns from 2004 to 2007, and as a result he owed $33,000 in unpaid taxes. On October 5, 2009 he was arrested, and entered a guilty plea on June 28, 2010.

In the end, Method Man paid a $106,000 fine and was released on a conditional discharge. This means that the arrest will be scratched from his records providing that he doesn’t get up to mischief. According to defense attorney Peter Frankel, Method Man hired someone to help him sort out his “tax issue” as soon as he became aware of it.

13. Chuck Berry

In 1979 the rock 'n' roll legend was sentenced to four months in jail and 1000 hours of community service when the IRS found Chuck Berry of evading $200,000 in taxes.

Coincidentally, that was the same year President Jimmy Carter invited the star to play at the White House.

14. Trey Songz

Trey Songz, a singer-rapper, received a tax lien from the IRS on October 8, 2015 over taxes he did not pay for his 2013 income.

He paid $750,000 to the IRS on October 28 to cover his $748,870.08 debt.

15. Vanessa Williams

In 2014, the IRS filed a $369,249 tax lien against singer-actress Vanessa Williams for unpaid 2011 taxes.

16. Busta Rhymes

Busta Rhymes, a rapper who rose to fame in the mid-90's, is facing two tax liens from the Department of Treasury: $611,000 for 2008 and $178,000 for 2012.

Altogether, he owes the IRS nearly $800,000 in unpaid taxes.

17. William Berroyer

In 2008, former businessman William Berroyer was settling a repayment deal with the IRS for his $60,000 tax bill when he tripped and fell over a telephone cord in a Hauppauge, NY IRS office. He spent 17 days in hospitals and rehab clinics for his injuries, and sued the IRS for $10 million (claiming that the injuries prevented him from enjoying his favorite activities).

A judge ruled in favor of Berroyer in 2014, but reduced his payment to $862,000. In addition, Berroyer's tax bill was waived.

18. Beanie Baby Creator

H. Ty Warner, creator of the famous 90s plush toy Beanie Babies, pled guilty in January 2014 to tax evasion of $25 million using Swiss bank accounts, but was able to avoid a prison sentence. Warner was given leniency by the judge for his philanthropic activity and charity donations.

He will instead serve two years’ probation and perform 500 hours of community service. Warner also agreed to pay $27 million in back taxes and interest, as well as a civil penalty of more than $53 million.

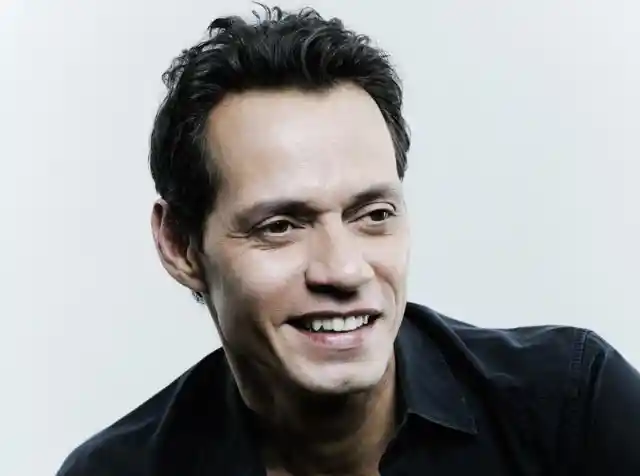

19. Jon Gosselin

In 2013, the Pennsylvania Department of Revenue filed a $39,000 tax lien against former reality TV star Jon Gosselin for taxes he did not pay in 2009.

20. Dionne Warwick

Legendary R&B singer Dionne Warwick filed for bankruptcy in 2013 after she battled the IRS for years over $10 million worth in tax debt dating back to 1991.

21. OJ Simpson

Former NFL player O.J. Simpson has found himself in hot water numerous times. He was accused of murder, acquitted, but then found liable in a civil suit. In 2008 he was sentenced to 33 years in prison for the robbery and kidnapping of a sports memorbilia salesman.

Now he is guilty of tax exasion. According to the IRS, he hasn't paid any taxes since 2007, and reportedly owes almost $180,000. A second lien was filed early in 2013, covering $17,015.99 in income taxes for 2011.

22. Katt Williams

The IRS has filed two tax liens on comedian Katt Williams: one in 2012 for failing to pay $3.2 million for 2008 and $829,352 for 2009, and another in 2010 for failing to pay $284,000

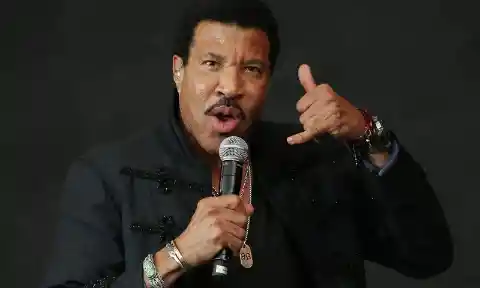

23. Lionel Richie

In 2012, the IRS filed a tax lien on legendary singer/songwriter Lionel Richie for $1.1 million in unpaid taxes from 2010.

24. 2012's Biggest Tax Fraud Case

In 2012, Krystle Marie Reyes fraudulently filed an Oregon state tax return that reported $3 million in earnings and managed to receive $2.1 million in tax refunds through state-issued refund debit cards. She then proceeded to go on a shopping spree, spending her fraudulently obtained refund money at a rate of tens of thousands of dollars per week.

This case is considered to be one of the largest instances of tax fraud in the history of Oregon.

25. Plaxico Burress

Plaxico Burress, a Super Bowl champion wide receiver, had a federal tax lien filed against him in 2012. The IRS said he and his wife did not pay income taxes in 2007 and 2009, leaving an outstanding bill of $98,064.76.

He was also the target of a New York State lien, alleging he owed $59,241 in unpaid income tax for 2007.

26. Stephen Baldwin

Stephen Baldwin, who made his name in movies and reality TV, was arrested in December 2012 and charged with failing to pay more than $350,000 in New York state income taxes. In addition, he reportedly did not file tax returns for 2008, 2009, and 2010.

By pleading guilty to one count of repeated failure to file and paying $100,000 to New York in restitution, he avoided prison time. He submitted his final payment of $100,000 in April 2014.

27. Lindsay Lohan

The IRS seized actress Lindsay Lohan's bank accounts due to her unpaid tax debt. Foretunately, the IRS released her from a tax lien in 2012 when she was able to pay off her 2009 using a $100,000 check actor Charlie Sheen gave to her.

However, debts from 2010 and 2011 remain, but her business manager reportedly said he is working on a settlement to pay off the six figure balance.

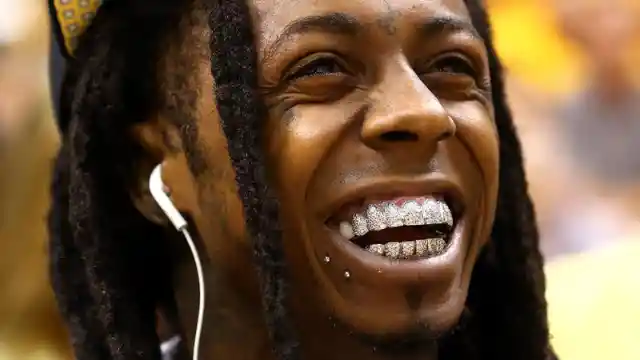

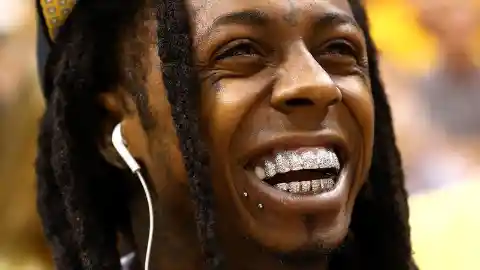

28. Lil Wayne

Rapper Lil Wayne has three separate tax liens against him: $1.13 million in December 2010 for tax years 2004, 2005, and 2007; $5.6 million in 2011 for tax years 2008 and 2009; and $7.72 million, which he paid at the end of 2012.

He currently has a $12,155,084.46 tax bill.

29. R. Kelly

Popular R&B singer R. Kelly gained his fame in the 90’s and early 2000’s and sold an estimated 50 million records worldwide, earning him a great fortune.

However, he failed to pay his taxes between the years 2005 and 2010 and reportedly owes $4.8 million for that time period. In addition, he owes nearly $1.4 million for 2011.

30. Lindsey Vonn

American skier Lindsey Vonn and her estranged husband reportedly owed $1,705,437 in back taxes from 2010, the year she won the gold medal during the Vancouver winter Olympics.

31. Kevin Federline

Kevin Federline, the ex-husband of famous pop star Britney Spears, faces $57,615 tax lien filed by the IRS for unpaid taxes in 2009 and 2010.

32. Helio Castroneves

In 2009, professional race car driver Hélio Castroneves was charged with filing years of false tax returns and evading $80 million in income taxes.

His defense attorney does not deny the charges, but says that the racer is not to blame due to a brain injury which had compromised his decision-making abilities.

33. Floyd Mayweather Jr

In 2009, Floyd Mayweather Jr. , a successful boxer with a history of tax problems, was given a $5.6 million bill by the IRS for unpaid taxes.

He has agreed to pay them since then.

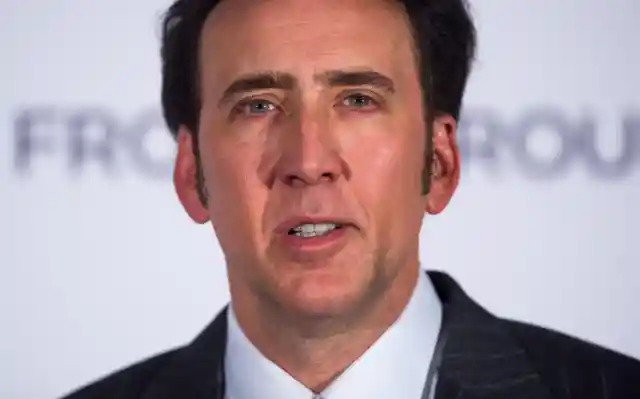

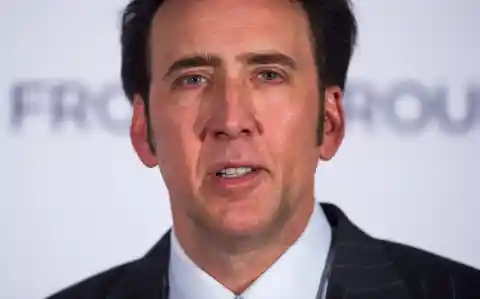

34. Nicolas Cage

Actor Nicolas Cage failed to pay $6.2 million in taxes on the $24 million he earned in 2007. He claimed that his accountant made mistakes.

In the end, he had to sell several of his houses to obtain the money to pay back the IRS.

35. Sinbad

Sinbad, also known as David Adkins, has been a bad boy when it comes to paying his taxes. In 2009 he was ranked #10 out of 250 worst tax offenders in the state of California. I guess he isn’t yet willing to give up that title.

He apparently owes California around $2.3 Million & the IRS $8.3 million from a slue of years ranging from 1998-2006 and 2009-2012. He plans to file bankruptcy in an attempt to expunge his tax debts.

36. Flavor Flav

Allegedly, Flavor Flav (William Jonathan Drayton, Jr.), frontman of hip hop group Public Enemy, owes $906,250.56 in back taxes from 2004-2006.

37. Wesley Snipes

Wesley Snipes, an actor who starred in several movies in the 90's and early 2000's, failed to pay taxes from 1999 to 2004. He tried to make the claim that he was a resident alien of the United States (he failed to realize that they have to pay taxes too).

Naturally, because he was born in Florida, the IRS didn’t accept his claim and he was sentenced to 3 years in prison. He managed to get out on bail, but he owes the IRS $17 million in taxes.

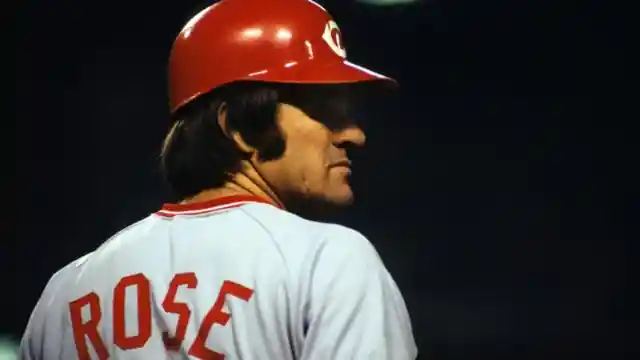

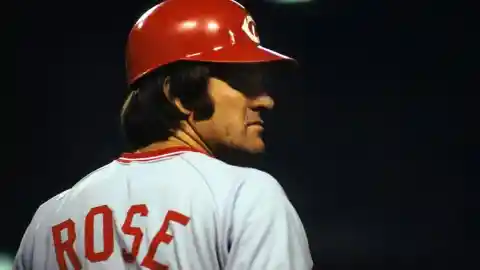

38. Pete Rose

Pete Rose, a famous baseball player, was accused of betting on baseball games, which he adamantly denied, but was later found guilty. In addition, the IRS accused him of not reporting income from special appearances and autographs, which led to a $50,000 fine and 1,000 hours of community service.

In 2003, he was found guilty of not paying taxes again, and had to pay $154,000 and sell his condo in Los Angeles.

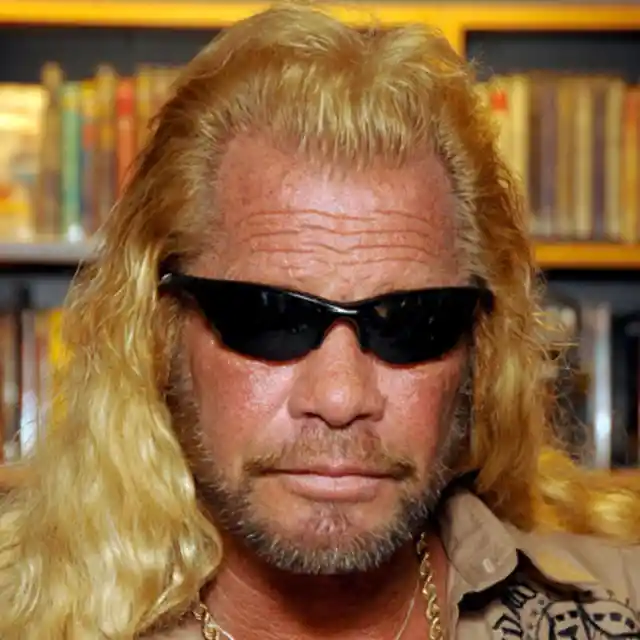

39. Duane Dog Chapman

Famous bounty hunter and reality TV star Duane “Dog” Chapman reportedly owes the IRS $2 million in unpaid taxes dating back to 2002.

40. Martha Stewart

Daytime TV host and home guru Martha Stewart failed to pay $220,000 worth of taxes on an estate she owned, claiming that she wasn’t there enough, so she shouldn’t pay them.

The IRS disagreed and forced her to pay the amount in 2002.

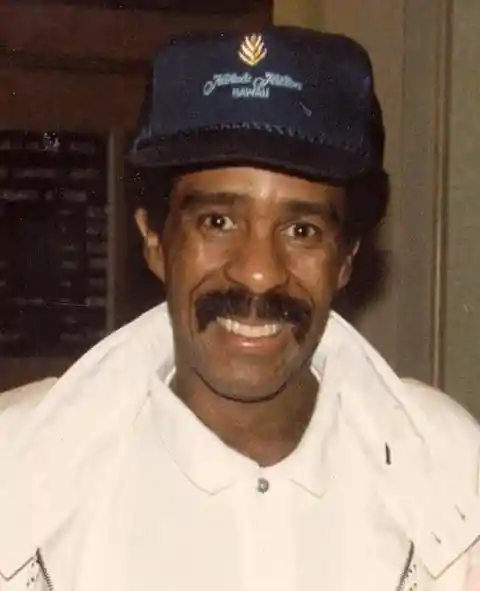

41. Richard Pryor

Comedian Richard Pryor spent 10 days in jail in 1974 for not paying his taxes.

During his trial he told the judge that he forgot to pay them.

42. The IRS Commissioner Himself!

IRS commissioner Joseph D. Nunan, Jr. made, and won, a $1,800 bet that Harry Truman would win the presidential election.

However, he neglected to report those winnings when filing his taxes. In 1952, his story became public and he was convicted of tax evasion.

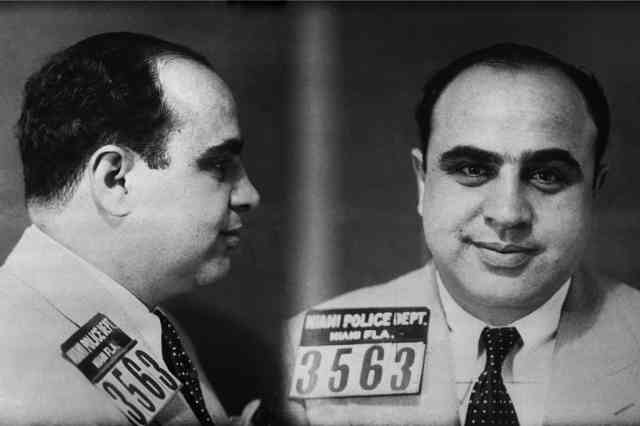

43. Al Capone

Famous and ruthless gangster Al Capone ran a bootlegging business during Prohibition, and that brought him incredible profits, but he concealed them from the IRS.

When he was captured and put on trial for handgun charges, the IRS was able to prosecute him for tax evasion, and in 1931 he received a sentence of 11 years in jail.

44. Swiss Bank Scandals

In 2014, Swiss bank Credit Suisse plead guilty to criminal charges of helping wealthy Americans file false U.S. tax returns and hide billions of dollars from U.S. tax collectors into overseas bank accounts.

This deed will cost the banking giant $2.6 billion in fines. Credit Suisse is the largest bank in 20 years to admit these charges publicly.

45. Dolce & Gabbana

45. Dolce & Gabbana

Italian fashion designers Domenico Dolce and Stefano Gabbana were sentenced to a prison term of one year and eight months in June 2013 for hiding hundreds of millions of Euros.

However, Italian law states that people with sentences of less than two years do not actually have to go to prison to serve their sentence. In October 2014, Italy's highest court overturned the sentences.

46. Boris Becker

In early 2000’s, former Number 1 German male tennis player Boris Becker was accused of living in Germany while claiming to live in Monte Carlo, and thus not paying 1.7 million Euros in taxes to the German government from 1991 to 1993. He admitted to tax evasion, and received a $500,000 fine and 2 years of probation.

He later moved to Switzerland to avoid paying taxes.

47. Sophia Loren

In 1982, Italian actress Sophia Loren served 18 days in prison for tax evasion.

48. Willie Nelson

In 1990, the I.R.S. came knocking on Willie Nelson’s door looking to collect the $16.7 million that he owed in back taxes, penalties and interest. While this amount of money is absolutely astronomical to most of us, it was actually negotiated down from an estimated $32 million.

Although Nelson lost the bulk of his assets because of the bill, he avoided any jail term and managed to pay off his debt a short few years later. Remarkably, more than $3 million of his tax money owed was raised from his 1992 album ""The I.R.S. Tapes: Who’ll Buy My Memories."

49. MC Hammer

It’s obvious that MC Hammer wishes he could tell the I.R.S. "U Can’t Touch This" when it comes to his money, the I.R.S. did not appreciate the early '90s superstar avoiding his tax responsibilities.

Having reportedly squandered the bulk of his fortune on a lavish lifestyle and lawsuits, Hammer’s money vanished faster than his single "Pray." MC Hammer still reportedly owes $600,000 to the I.R.S. Hammer time indeed.

50. Flo Rida

Despite having built an impressive career in music, Flo Rida might find himself crying all the way to prison if he doesn’t pay his taxes soon. In September of 2012, the I.R.S. discovered the Florida (Flo Rida, get it?) native hadn’t filed his taxes in a few years and owed in the vicinity of $1.1 million to the government.

As a result of the money owed, the I.R.S. put a lien against Flo Rida’s South Florida estate. Resolution remains pending.

51. Jerry Lee Lewis

Chances are very good that Jerry Lee Lewis is not a big fan of the I.R.S. In 1984, the controversial singer surrendered to authorities to face charges of trying to avoid paying almost $1 million in taxes for the years between 1975 and 1980.

Lewis was eventually acquitted of those charges, although in a completely shameless display of not being able to handle his money, Lewis would set up a 1-900 number for people to make financial donations to his troubled wallet.

52. Nas

Owed more than a reported $6 million for the years between 2006 and 2010, the I.R.S. is taking the extraordinary steps of garnishing wages made by hip-hop superstar Nas until his tax bill is paid in full.

The Georgia Department of Revenue filed a lien against the rapper’s income, forcing giant concert promoter Live Nation as well as music publishers ASCAP and BMI to withhold revenues that would otherwise be paid to the star. He might be "The Don" on record, but clearly Nas needs a financial Don to help him out of such a situation.

53. Luciano Pavarotti

You know that if someone negotiates their tax bill down to be $12.5 million, they must be doing fairly well for themselves. The deceased opera singer reportedly negotiated with the Italian government for 40 days before arriving at the $12.5 million figure. Just three months before this settlement however, Pavarotti had already paid $2.5 million in back taxes.

"I wish to emphasize that I am innocent," Pavarotti told Italy’s La Stampa Newspaper. "I have always paid my taxes wherever I have sung, but the Italian state believes I have not paid enough," he said. "I do not want to be known as a tax evader."

54. Montell Jordan

The I.R.S. filed an unpaid tax lien against the "This Is How We Do It" singer, alleging that he owed just over $600,000 in unpaid taxes between 1999 and 2001. In a bid to settle his tax bill, Jordan reportedly sold his music catalogue, however the money never made its way to the I.R.S. — another branch of the government is holding it.

The cash was sitting frozen in an account administered by the U.S. Trustee Program, a division of the Department of Justice that oversees bankruptcy cases. Jordan declared himself bankrupt in 2004.

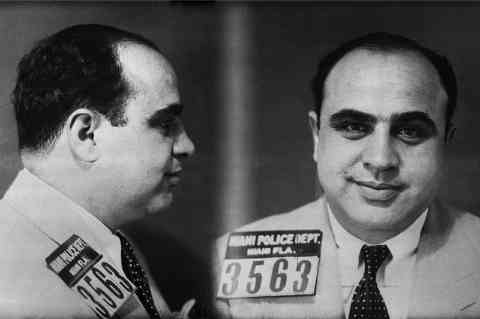

55. Marc Anthony

He may be the husband of superstar Jennifer Lopez, but fame didn't remove his obligation to pay taxes. In 2007, the IRS served Anthony with $2.5 million in back tax bills.

Then in 2010, he received two additional bills totaling over $3 million for unpaid taxes on real estate. Marc Anthony blames management, but few empathize after the IRS claimed numerous years of zero tax payments.

56. Annie Leibovitz

It was December 8, 1980 when celeb portrait photographer Leibovitz captured John Lennon and Yoko Ono for the cover of Rolling Stone. Since then, her notoriety rocketed almost as fast as her spending.

After years of extravagance and poor financial management, it seems paying taxes was just one expense she couldn't afford. Picture this

57. Darryl Strawberry

Mets or Yankees? Strawberry led them both to World Series titles, but like Pete Rose, he stumbled when it came to claiming taxable income. Both can likely recite their stats for every season played, but neither was very good at recalling income from autograph and memorabilia shows.

After years of signing away without paying taxes, both received tax evasion convictions. The lesson? If you earn money from it, so should Uncle Sam.

58. Survivor's Richard Hatch

He survived the first season of Survivor, winning $1 million. But when it came time to paying his taxes, he stayed on the island and voted CBS off, claiming the network agreed to pay his taxes. In 2006, Hatch was found guilty of tax evasion and served part of a six-year prison sentence as a result.

Then in March 2011, he returned for his third prison term for failing to file amended returns. Celebrity tax lesson

59. Heidi Fleiss

Known as the "Hollywood madam," Heidi Fleiss was sentenced in 1997 on tax evasion charges in connection with her high-profile prostitution ring. She served part of her seven-year sentence in prison and a halfway house.

Her excuse? Apparently it's a bit challenging to pay legal taxes on illegal earnings.

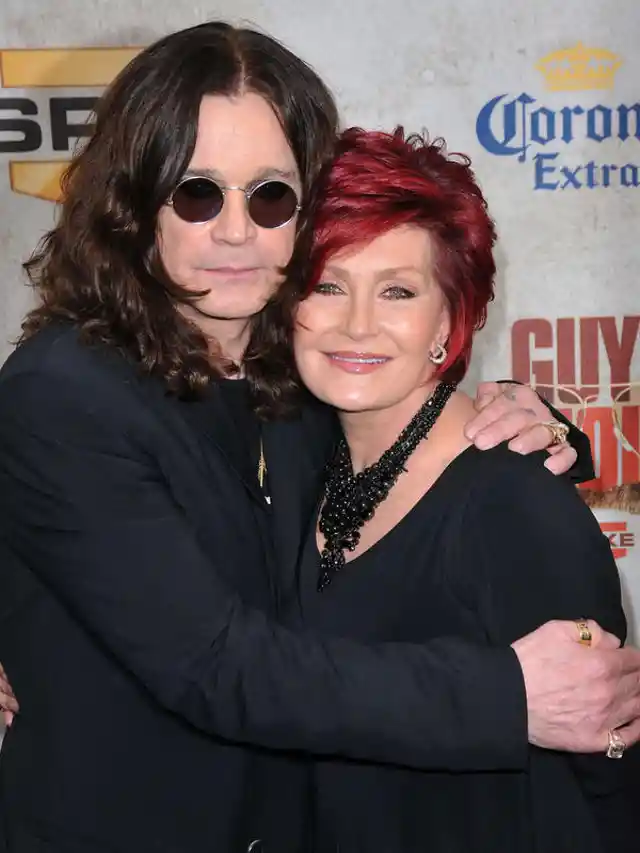

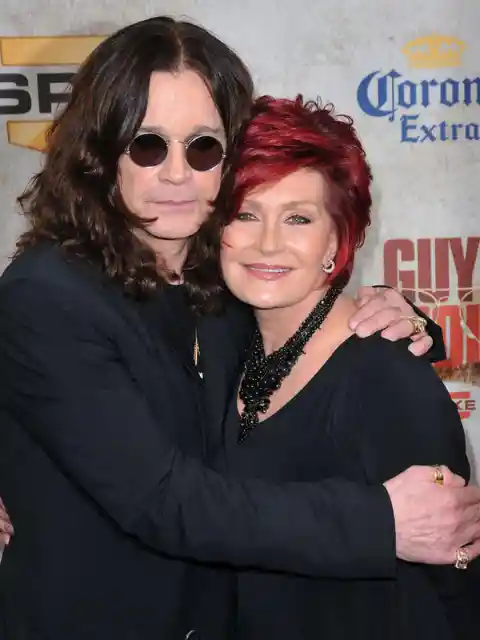

60. Ozzy and Sharon Osbourne

In 2011, Ozzy and Sharon Osbourne quickly paid off their $1.7 million U.S. tax debts after a lien was placed on their property.

Must be nice to just have $1.7 mil laying around!

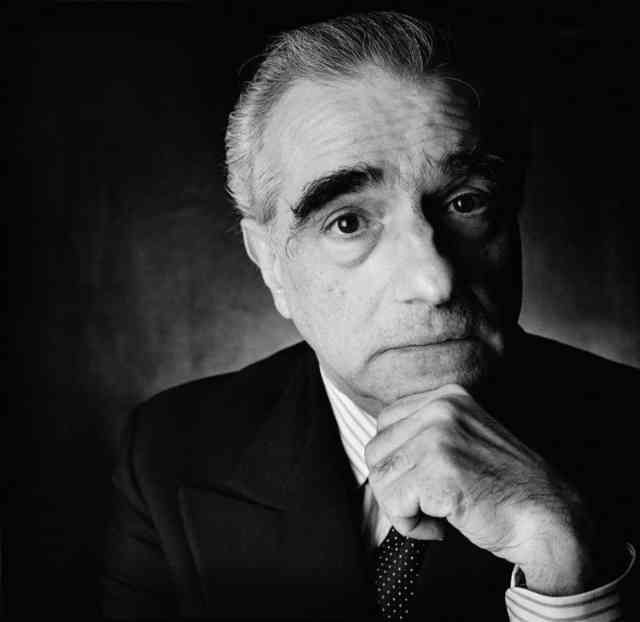

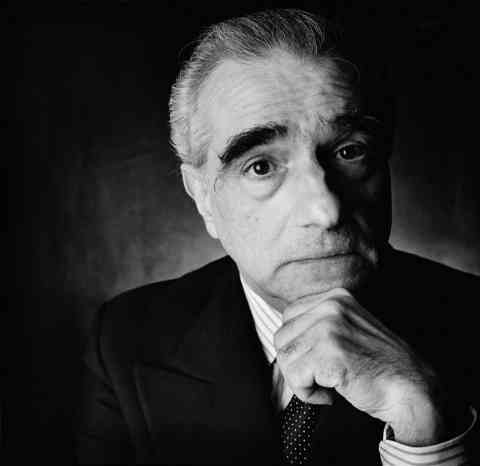

61. Martin Scorsese

In 2011, Marin Scorsese was hit with a $2.85 million IRS tax lien - but that wasn't Marty's first IRS shenanigan. In 2002-2004, he had other back taxes owed (which he paid off quickly).

You've got Academy Awards, Marty, surely you have an accountant?!

62. Val Kilmer

The IRS filed a $538,858 tax lien against him in July 2009 in Bergen County, N.J. In September 2004, the New Mexico Court of Appeals ruled against Kilmer and his ex-wife, actress Joanne Whalley, in a dispute over a tax refund of more than $300,000 sought by the couple. And Kilmer just paid off a tax debt of $538,858 seven months before he was faced with his current tax lien.

Could Kilmer's tax troubles be a sign that he might need to consider bankruptcy? It's very possible.

63. Kelly Osbourne

Must be an Osbourne thing...in 2011, it was reported that Kelly Osbourne owed more than $30,000 in back taxes to the state of California.

64. Judy Garland

Judy Garland owed the IRS $4 million, so they repossessed her home, after which she moved from hotel to hotel.

65. Mike "The Situation" Sorrentino

In 2014, Mike "The Situation" Sorrentino was indicted for tax fraud for not paying his full tax bill on $8.9 million in earnings.

Those abs can't get you out of everything, buddy!

66. Pamela Anderson

Pamela Anderson has a history of running away from the IRS (presumably in slow motion, on a beach).

In 2009, a lien was filed against her for $1.7 million, then in 2012, she got hit with another lien for about $400,000.

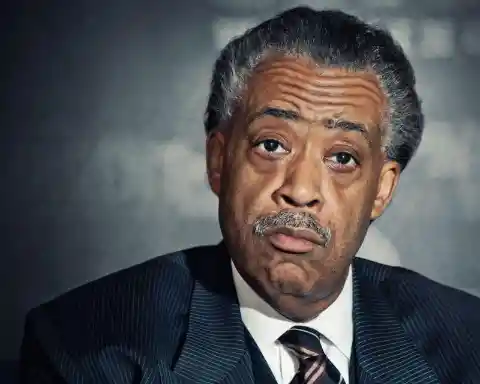

67. Al Sharpton

In 1989, Al Sharpton was charged and later acquitted of tax evasion. In 2009, the IRS filed a lien against Sharpton of over $538,000 in back taxes.

Get it together, Al!

68. Mary J. Blige

In 2013, Mary J. Blige was hit with a $3.4 million tax lien from the IRS.

The State of New Jersey also claimed that Blige owed it $901,769.65 in back taxes. She settled the matter with NJ, but the Feds are still causing drama.

69. Girls Gone Wild Creator

In 2007, noted dirtbag Joe Francis was indicted for two misdemeanor counts of tax evasion, reduced from one felony charge.

Guess the Feds didn't "go wild" for his antics

70. Leona Helmsley

Leona Helmsley was fined $7.1 million for tax evasion in 1989. Her former housekeeper quoted her as saying "We don't pay taxes.

Only the little people pay taxes."

71. Andre Agassi

Tennis pro Andre Agassi was hit with a tax bill on sponsorship income that he earned in Britain.

72. Nina Simone

Nina Simone decided not to pay taxes in protest to the Vietnam War.

She was arrested for tax evasion in 1978, but remained a boss.

73. Ruben Studdard

In 2012, a tax lien of $180,216.73 was placed against Ruben Studdard.

He also had a property lien filed against him in 2008.

74. Jack Abramoff

In 2005, former lobbyist Jack Abramoff pleaded guilty to charges of conspiracy, mail fraud, and tax evasion. In 2002 Abramoff was a registered lobbyist for the General Council for Islamic Banks, for which he was paid $20,000. Saleh Abdullah Kamel, the chairman of this Council, was investigated for allegedly funding terrorism and terrorists including Osama Bin Laden.

Abramoff has a whole wikipedia page dedicated to his scandals. Abramoff raised over $100,000 for President George W. Bush.

75. Connie Sims

In New Mexico, a former office manager of a surveillance equipment company was sentenced to 366 days in prison for federal tax evasion. It was related to an indictment filed in September 2014 charging her for not reporting the correct income in her 2009-2012 tax returns.

She admitted to writing checks to herself from the company and not reporting the income as compensation on her returns. She was also ordered to pay $170,000 in taxes and a $100,000 fine to the IRS.

76. ComputerLand Billionaire

One of the world's most wanted tax evaders, William H. Millard, founder of 1980's computer retail chain ComputerLand Corp., reportedly owes over $100 million in unpaid taxes to the IRS. After selling the company in the late 1980's he moved to The Northern Mariana Islands, which is a U.S.

commonwealth. He never reported his income to the IRS while in the commonwealth, and thus paid no taxes during that period. Soon after he disappeared, and it is reported that he now resides in The Cayman Islands, a notorious tax haven.

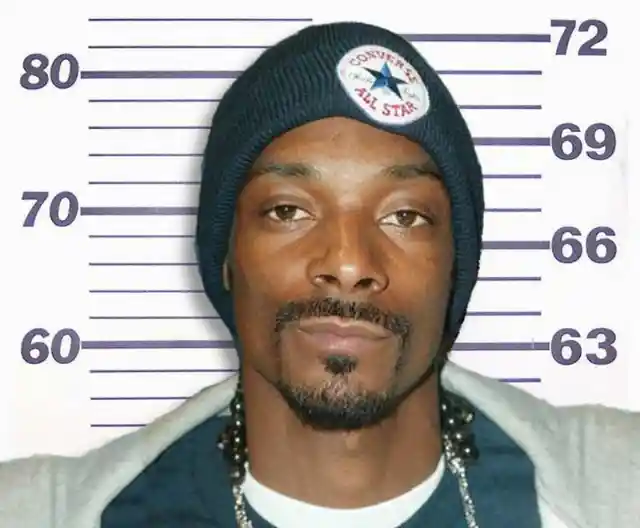

77. Snoop Dogg

Snoop Dog knows how to get the taxing authorities off his back. He pays them!

A lien was filed back in February 2013 alleging that the rapper owed for unpaid taxes from 2009 & 2011 and in April the lien was released. Well done Snoop.

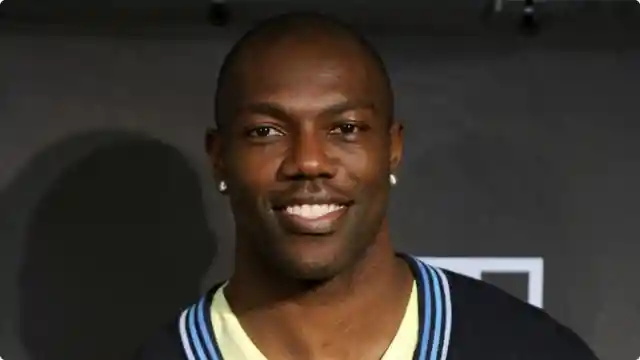

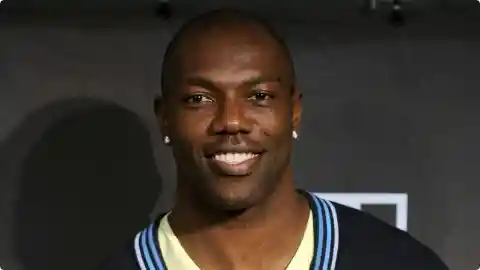

78. Terrell Owens

In February 2013 the Federal Government placed a lien on the former NFL star for failing to pay taxes for 3 years. In 2005 he owed a total of $294,661.71, in 2007 he owed $46,504.00 & for 2009 the bill came in at $97,747.81, making for a grand total of (drumroll please) $438,913.52, which he paid in full.

The lien was officially released in June 2013.

79. Courtney Love

Courtney Love is in trouble with Uncle Sam over and over. A lien was filed in July of 2013 alleging the singer owes $3,236.23 from 2009 and an additional $263,624.78 from 2011.

And all this after she finally cleared up her unpaid taxes from 2007 which totaled over $224,000.

80. Dean Cain

The IRS is like Kryptonite for this superman actor.

He reportedly owes close to $200,000 from failing to pay his 2011 & 2012 taxes.

81. Teri Polo

This is not Teri’s first dance with the tax man.

The IRS filed a lien against the “Meet the Parents’ actress, for failing to pay $122,929.07 of unpaid taxes from 2011

82. Sheree Whitfield

This Georgia housewife, from the reality hit “The Real Housewives of Atlanta”, has to face reality and pay up!

Uncle Sam claims she owes for unpaid taxes from 2009 & 2010 totaling $41,752.83.

83. Michael Madsen

The ‘Kill Bill’ star & ‘Reservoir Dogs’ actor had 2 separate liens filed against him for unpaid taxes in 2004 and 2006. The 2004 lien was for $317,443.95 and for 2006 the bill was $327,099.47.

Even tough guy actors are no match for the tax man!

84. Jermaine Dupri

Just when he thought he was all done with the tax man…Mr. Dupri recently paid off a $3 million tax lien for taxes owed from 2006 to the the IRS.

He also paid off a $500,000 debt to the state of Georgia, only now to find out that he actually still owes the IRS $798,692.35 for unpaid taxes for 2008, 2010 & 2011. Maybe it’s time to find another accountant?

85. Chris Tucker

This jokester had both the IRS and the State of GA knocking on his door to collect in 2013. The Feds say Mr.

Tucker owes them about $11.5 million, while the Peach State filed a lien against the comedian for $592,594.82 for unpaid taxes from 2007, and another lien for $392,332.16 from unpaid 2006 taxes. The Georgia Debt has since been paid in full but the Federal Government is still looking for their pay day.

86. Manny Pacquiao

This International boxing star is in a world of hurt with not only the US taxing authorities but international ones as well. Both the Philippines and the US claim the boxing champ owes millions in unpaid taxes. In the Philippines, his home country, the star owes approximately $50,000,000 and here in the US he owes another $18,000,000.

His bank accounts have been frozen in the Philippines and a lien has reportedly been placed on one of his Manila properties. Here is the USA he has unpaid taxes for years 2006, 2007, 2008, 2009 & 2010.